-

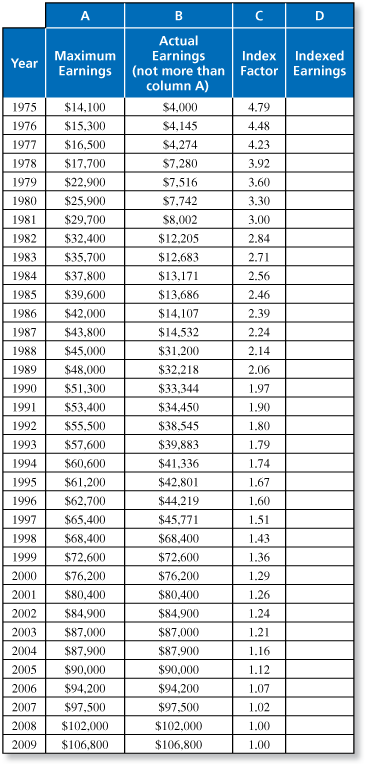

A worker's annual earnings are adjusted, or "indexed," to express the earnings in terms of today's wage levels. The 35 greatest indexed earnings are then averaged to get the average indexed monthly earnings (AIME). After working for 35 years, a worker retired in 2009 at the age of 62. The table shows the worker's information.

Multiply the amounts in column B by the index factors in column C, and enter the results in column D.

-

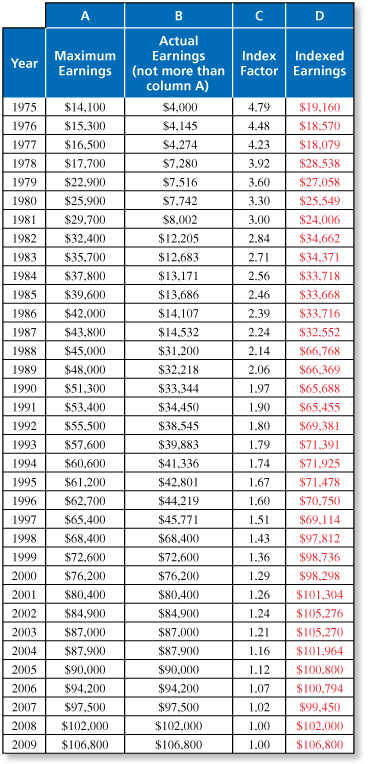

The completed table is shown below.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

A worker's annual earnings are adjusted, or "indexed," to express the earnings in terms of today's wage levels. The 35 greatest indexed earnings are then averaged to get the average indexed monthly earnings (AIME). After working for 35 years, a worker retired in 2009 at the age of 62. The table shows the worker's information.

Find the sum of the amounts in column D. Then divide the sum by 420 (the number of months in 35 years). Round down to the next lowest dollar. This is the worker's AIME.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

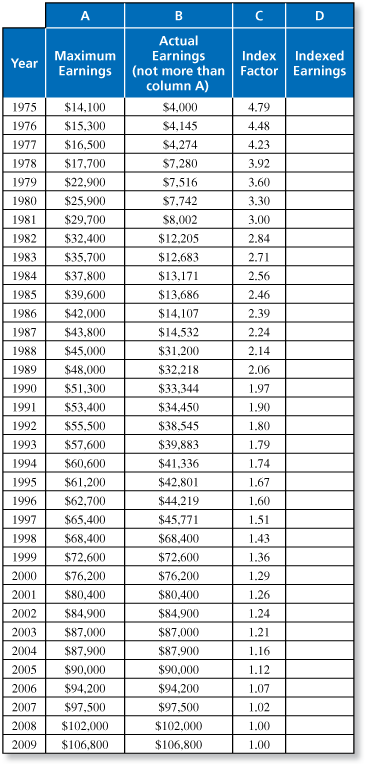

A worker's annual earnings are adjusted, or "indexed," to express the earnings in terms of today's wage levels. The 35 greatest indexed earnings are then averaged to get the average indexed monthly earnings (AIME). After working for 35 years, a worker retired in 2009 at the age of 62. The table shows the worker's information.

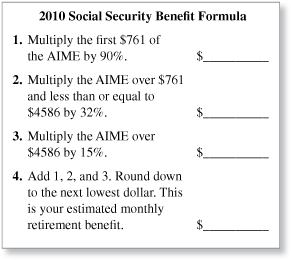

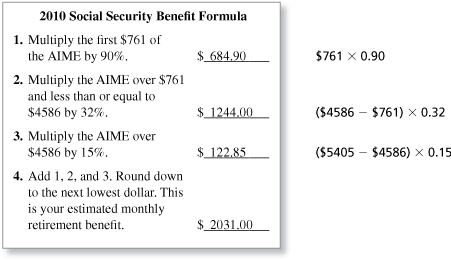

Use the Social Security benefit formula on page 241 to estimate the worker's Social Security monthly retirement benefit at age 62.

-

From Exercise 20, the average indexed monthly earnings are $5405.

The completed formula is shown below.

By retiring at age 62, the person receives only 75% of this amount.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

A worker's annual earnings are adjusted, or "indexed," to express the earnings in terms of today's wage levels. The 35 greatest indexed earnings are then averaged to get the average indexed monthly earnings (AIME). After working for 35 years, a worker retired in 2009 at the age of 62. The table shows the worker's information.

Explain why the Social Security benefit formula is designed to pay a higher percent for lower AIMEs.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

What factors may prevent the economic dependency ratio from being 100% accurate? Explain your reasoning.

-

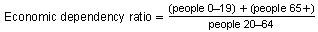

The economic dependency ratio is the number of people below age 20 or above age 64 divided by the number of people ages 20 to 64.

In principle, the economic dependency ratio is supposed to measure the ratio of "working people" to "nonworking people."

The problem with doing this simply by a person's age is clear.

- Many people under aged 20 work and contribute to the system.

- Many people aged 20 to 64 do not work and therefore to not contribute to the system. Moreover, many who do not work actually draw benefits from the system.

- Many people aged 65 and over continue to work full time. This is especially true of many successful business owners who contribute the maximum monthly amount to the system.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Do you think the Social Security system will exist when you retire? Use the concepts in this section to defend your answer.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.