-

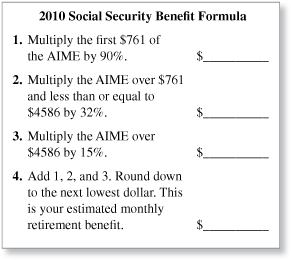

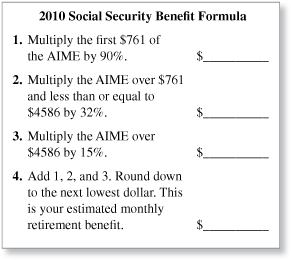

Social Security benefits are based upon lifetime earnings and retirement age. The formula shown is applied to a worker's average indexed monthly earnings (AIME) to arrive at the basic benefit, or primary insurance amount (PIA). This is how much the worker will receive each month after reaching full retirement age. Multiply this amount by 75% to find the estimated monthly retirement benefit at age 62.

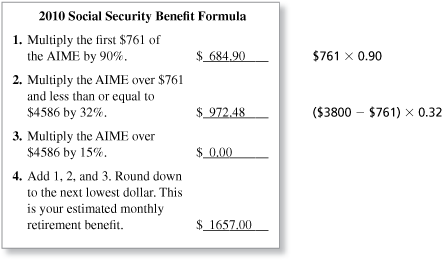

A worker's AIME is $3800. Estimate the worker's PIA at full retirement age. (See Example 3 and Example 4.)

-

The completed formula is shown below. The person would receive $1657 per month.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

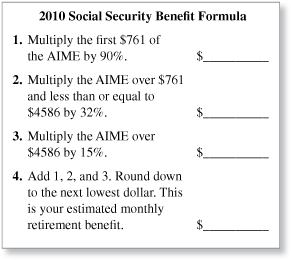

Social Security benefits are based upon lifetime earnings and retirement age. The formula shown is applied to a worker's average indexed monthly earnings (AIME) to arrive at the basic benefit, or primary insurance amount (PIA). This is how much the worker will receive each month after reaching full retirement age. Multiply this amount by 75% to find the estimated monthly retirement benefit at age 62.

A worker's AIME is $6200. Estimate the worker's PIA at full retirement age. (See Example 3 and Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

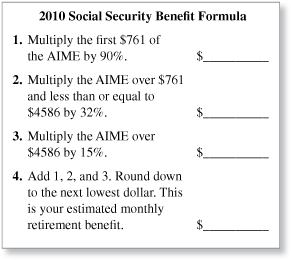

Social Security benefits are based upon lifetime earnings and retirement age. The formula shown is applied to a worker's average indexed monthly earnings (AIME) to arrive at the basic benefit, or primary insurance amount (PIA). This is how much the worker will receive each month after reaching full retirement age. Multiply this amount by 75% to find the estimated monthly retirement benefit at age 62.

A worker's AIME is $4500. Estimate the worker's PIA at age 62. (See Example 3 and Example 4.)

-

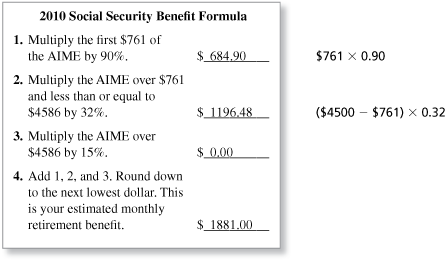

The completed formula is shown below

At full retirement age, the person would receive $1881 per month.

At age 62, the person receives only 75% of this amount.

The person will receive about $1410 per month in Social Security.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

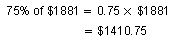

Social Security benefits are based upon lifetime earnings and retirement age. The formula shown is applied to a worker's average indexed monthly earnings (AIME) to arrive at the basic benefit, or primary insurance amount (PIA). This is how much the worker will receive each month after they reach full retirement age. Multiply this amount by 75% to find the estimated monthly retirement benefit at age 62.

What do you think your AIME will be when you retire? Estimate how much you will receive each month from Social Security at full retirement age. (Neglect inflation.) (See Example 3 and Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

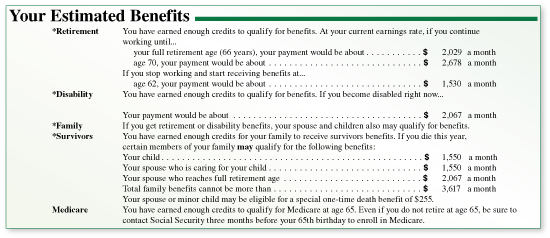

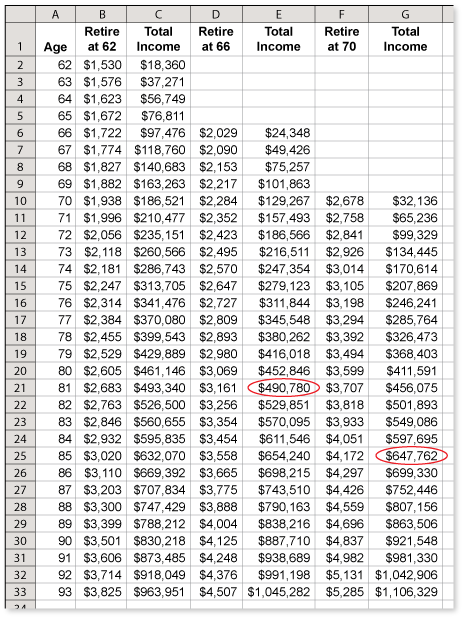

Use the information below taken from a worker's annual Social Security Statement. Assume a 3% cost-of-living increase each year. The worker has just reached 62 years of age. How long would the worker have to live to make waiting for full benefits more economical than retiring at age 62? (See Example 4.)

-

Use a spreadsheet to calculate the total amount of benefits received for each retirement age.

If the worker lives to be 82, then he or she will receive more total benefits by retiring at age 66. If the worker lives to be 86, then he or she will receive more total benefits by retiring at age 70.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Use the information below taken from a worker's annual Social Security Statement. Assume a 3% cost-of-living increase each year. The worker has just reached 62 years of age. How long would the worker have to live to make waiting for the benefits at age 70 more economical than retiring at age 62? (See Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.