-

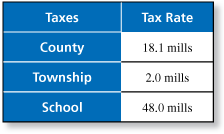

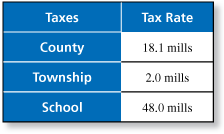

You own a $90,000 home in Pennsylvania. The assessment level is 20%. The annual property tax rates on your home are shown. What is the combined tax rate?

-

The combined tax rate is

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

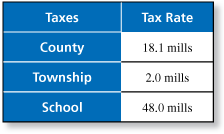

You own a $90,000 home in Pennsylvania. The assessment level is 20%. The annual property tax rates on your home are shown. What is the property tax for your home?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

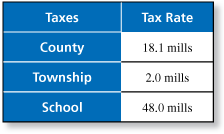

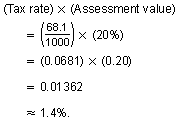

You own a $90,000 home in Pennsylvania. The assessment level is 20%. The annual property tax rates on your home are shown. What is the effective property tax rate?

-

The effective property tax rate is

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

You own a $90,000 home in Pennsylvania. The assessment level is 20%. The annual property tax rates on your home are shown. County and township taxes are due by June 30. When paid by April 30, there is a 3% discount on county taxes and a 2% discount on township taxes. How much is due when you pay by April 30?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

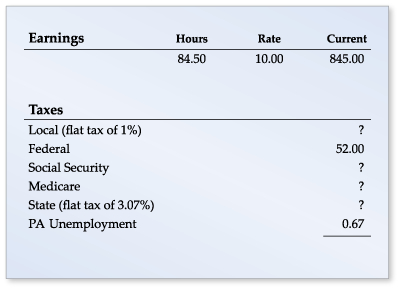

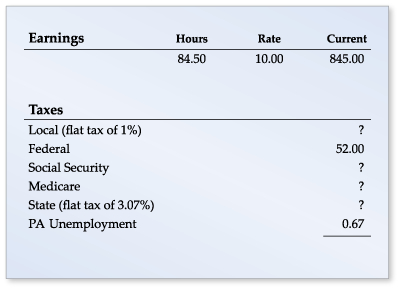

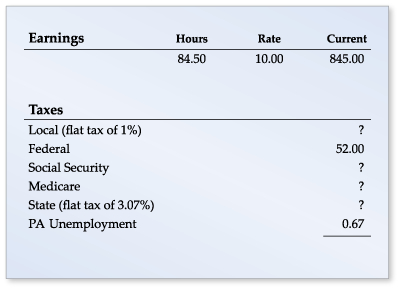

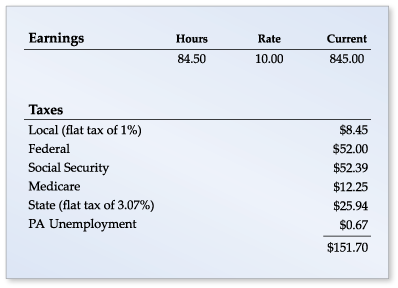

Use the paystub of a college student residing in Pennsylvania. Calculate the local and state taxes.

-

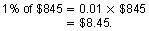

The local tax is a flat tax of 1%. So, this employee's local tax is

Pennsylvania has a flat state tax rate of 3.07%. So, this emlpoyee's state tax is

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Use the paystub of a college student residing in Pennsylvania. Calculate the Social Security and Medicare taxes.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Use the paystub of a college student residing in Pennsylvania. What percent of the earnings go to taxes?

-

The completed pay stub is shown below.

The effective tax rate for this college student is

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

A worker's annual Social Security Statement indicates that he would receive $1072 per month by retiring at age 62, or $1938 per month by retiring at age 70. How long would he have to live to make waiting until age 70 more economical? Assume a 3% cost-of-living increase each year.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.