-

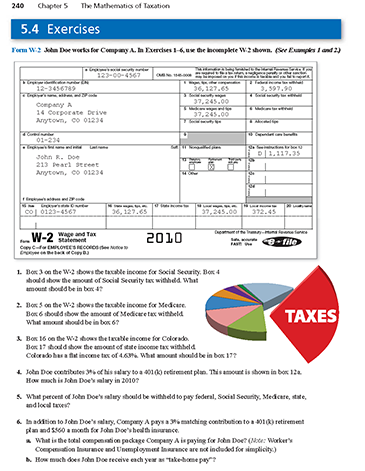

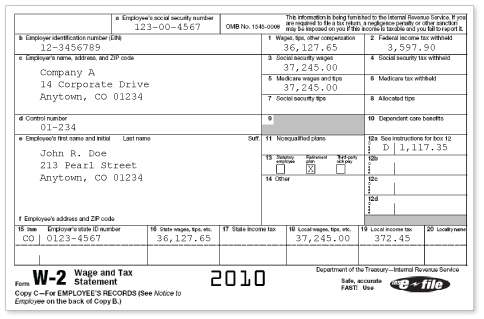

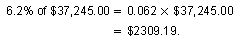

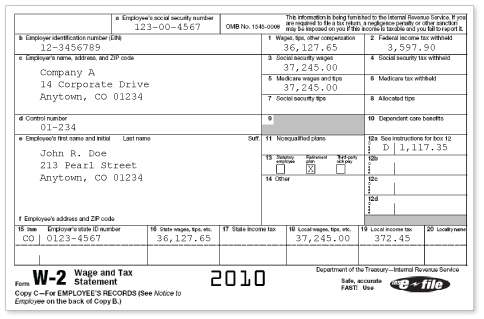

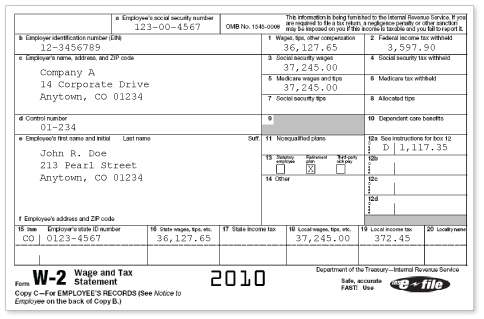

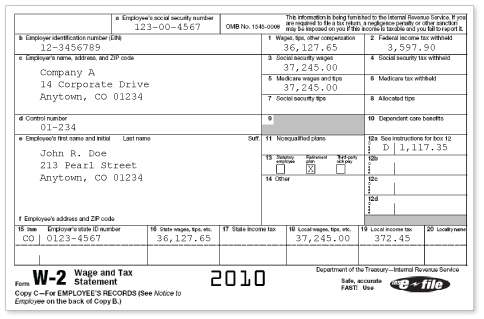

Box 3 on the W-2 shows the taxable income for Social Security. Box 4 should show the amount of Social Security tax withheld. What amount should be in box 4? (See Example 1 and Example 2.)

-

In 2010, the Social Security tax for employees was 6.2%. So, this employee's Social Security tax is

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

Box 5 on the W-2 shows the taxable income for Medicare. Box 6 should show the amount of Medicare tax withheld. What amount should be in box 6? (See Example 1and Example 2.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

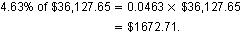

Box 16 on the W-2 shows the taxable income for Colorado. Box 17 should show the amount of state income tax withheld. Colorado has a flat income tax of 4.63%. What amount should be in box 17? (See Example 1 and Example 2.)

-

In 2010, Colorado had a flat income tax rate of 4.63%. So, this employee's Colorado income tax was

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

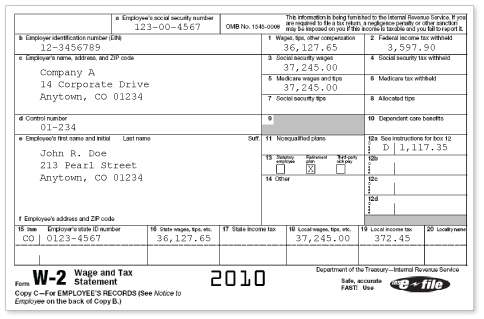

John Doe contributes 3% of his salary to a 401(k) retirement plan. This amount is shown in box 12a. How much is John Doe's salary in 2010? (See Example 1 and Example 2.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

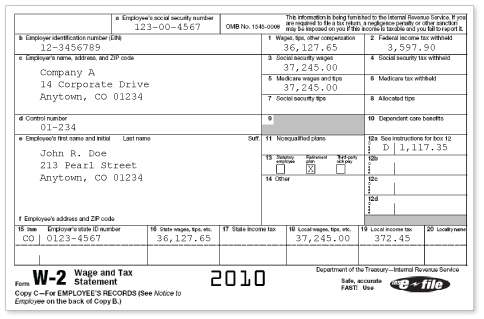

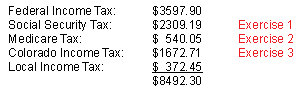

What percent of John Doe's salary should be withheld to pay federal, Social Security, Medicare, state, and local taxes? (See Example 1 and Example 2.)

-

From the W-2 statement, add boxes 2, 4, 6, 17, and 19 to find this employee's total tax liability.

This means that the total percent paid for taxes was

So, this taxpayer paid almost a quarter of his gross wages for taxes.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

In addition to John Doe's salary, Company A pays a 3% matching contribution to a 401(k) retirement plan and $560 a month for John Doe's health insurance. (See Example 1 and Example 2.)

- What is the total compensation package Company A is paying for John Doe? (Note: Worker's Compensation Insurance and Unemployment Insurance are not included for simplicity.)

- How much does John Doe receive each year as "take-home pay"?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.