-

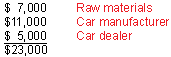

During the production of a car, value is added by the following.

- Raw materials manufacturers: $7000

- A car manufacturer: $11,000

- A car dealer: $5000

The sales tax rate is 6.0%. What is the sales tax on the car? (See Example 5.)

-

To find the retail price of the car, add the three given values.

The sales tax on the car is

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

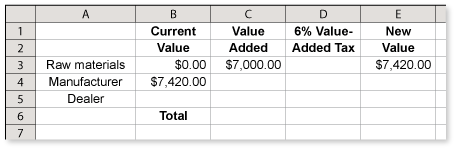

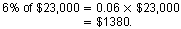

During the production of a car, value is added by the following.

- Raw materials manufacturers: $7000

- A car manufacturer: $11,000

- A car dealer: $5000

Use the spreadsheet to find the value-added tax of 6% at each stage. Compare the value-added tax of 6% with a sales tax of 6%. (See Example 5.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Using the value-added tax approach, what is the retail price of the car? (See Example 5.)

A spreadsheet is available to help you complete this exercise.

-

Use a spreadsheet to find the value-added tax at each of the three stages of manufacturing and retailing.

The retail price of the automoble is $24,380. That is the same total found in Exercise 15 found with a retail value of $23,000 and a sales tax of 6%.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

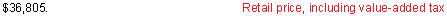

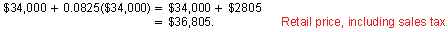

During the production of a truck, value is added by the following.

- Raw materials manufacturers: $11,000

- A truck manufacturer: $16,000

- A truck dealer: $7000

The sales tax rate is 8.25%. What is the sales tax on the truck? (See Example 5.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

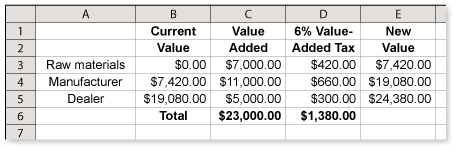

During the production of a truck, value is added by the following.

- Raw materials manufacturers: $11,000

- A truck manufacturer: $16,000

- A truck dealer: $7000

Use a spreadsheet to find the value-added tax of 8.25% at each stage. Compare the value-added tax of 8.25% to a sales tax of 8.25%. (See Example 5.)

-

Enter the given information into a spreadsheet.

Using a value-added tax, the retail price for the consumer would be

Using a sales tax of 8.25%, the retail price for the consumer would be

So, either way, the consumer ends up paying the same retail price.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Using the value-added tax approach, what is the retail price of the truck? (See Example 5.)

A spreadsheet is available to help you complete this exercise.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

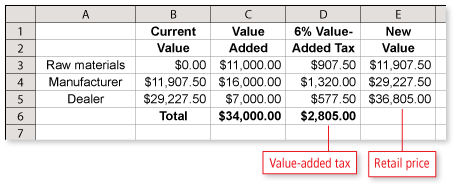

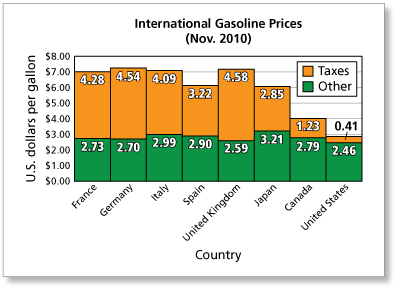

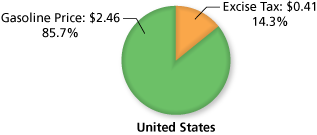

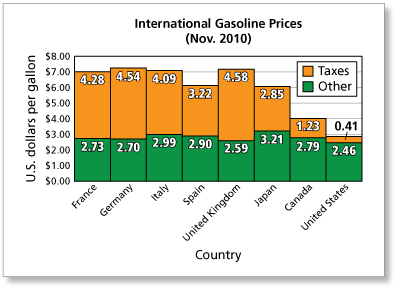

The graph shows the prices of gasoline in eight countries. Use percent to compare the taxes collected per gallon of gasoline in the United States with those collected in Germany. (See Example 6.)

-

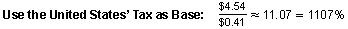

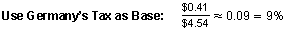

The gasoline excise tax in Germany is $4.54 per gallon. In the United States, the gasoline excise tax is $0.41 per gallon. There are different ways to compare these two amounts.

"Gasoline excise tax in Germany is about 11 times the gasoline excise tax in the United States."

"Gasoline excise tax in Germany is about 1100% of the gasoline excise tax in the United States."

"Gasoline excise tax in the United States is less than one tenth of the gasoline excise tax in Germany."

"Gasoline excise tax in the United States is about 9% of the gasoline excise tax in Germany."

A different approach to answering the question is to compare the percent of the retail value that is excise tax in each country.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

The graph shows the prices of gasoline in eight countries. Describe any patterns you see in the graph. (See Example 6.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 1 commentsGuest 4 years ago |i really don't see a pattern0 0