-

While on vacation in Florida, you buy a pair of sunglasses for the beach. The state sales tax rate in Florida is 6%. What is the local sales tax rate?

-

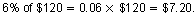

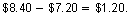

The state sales tax of 6% on $120 is

Because the total sales tax was $8.40, the local sales tax was

This is a rate of

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

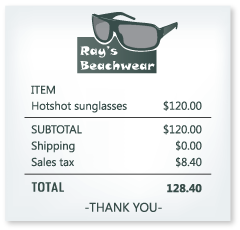

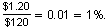

Your friend loves the sunglasses you bought while on vacation in Florida. She decides to buy the same pair of sunglasses from the Ray's Beachwear website. What might be the total cost for her order? Explain.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

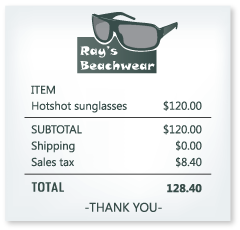

Some items are not subject to sales tax in certain tax jurisdictions. The rules for exempt status can vary greatly from state to state. The state sales tax rate applied on the sales receipt shown below is 6%. Which item is exempt from sales tax?

-

At first glance, it seems like there is more than one possibility. However, after some trial and error, you can discover that there is a 6% sales tax rate on

One state in which this transaction could have occurred is Pennsylvania. It has a 6% state sales tax on "nonneccessities." Necessities, such as ordinary groceries and ordinary clothing, are tax exempt.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

One of the main purposes of an excise tax is to discourage certain behavior. Name one item or service (not listed in this textbook) that you think should have an excise tax. Explain how you would define the tax structure, including the rate.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

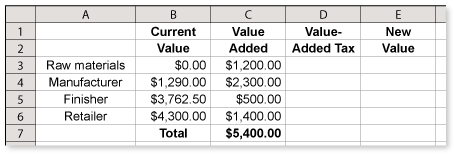

The value-added tax spreadsheet shows each stage of the production of a dining room table set. Complete the spreadsheet. What is the tax rate?

-

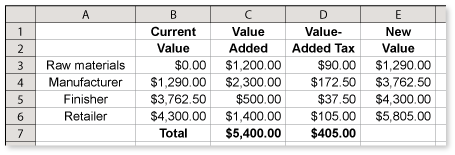

From the given spreadsheet, you can see that there is a tax of $90 on the raw materials of $1200. This is a rate of

Using this rate, you can complete the spreadsheet as follows.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

There has been some discussion about whether the United States should implement a national sales tax in addition to existing state and local sales taxes. Suppose you are entering a debate about a national sales tax. Use the Internet to research the topic. Would you be in favor of or opposed to a national sales tax? Explain your reasoning.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.