-

In Example 5, a spreadsheet was used to estimate how much you can withdraw from a retirement plan. There are also many websites that offer retirement income calculators such as Ameriprise Financial, EstimatePension.com, and Money-Zine.com.

-

It’s never too early to start planning for retirement. As the cost of living increases each year, you will need to have more money set aside for the future. How do you know how much to save? Use the Retirement Calculator from the American Association of Retired Persons website to find out.

You can also talk to a financial advisor about setting up a retirement account based on your needs and your preferences. They offer other financial advice including protecting yourself with critical illness insurance and life insurance.

-

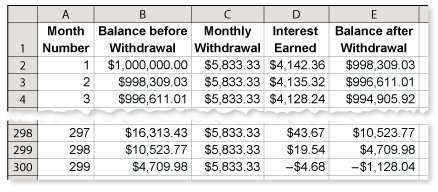

- A spreadsheet showing this plan is shown below.

The balance will run out during the 299th month. This plan would last you almost 25 years, or until you're 93 years old.

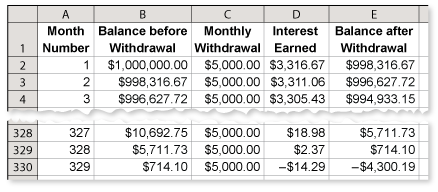

- A spreadsheet showing this plan is shown below.

The balance will run out during the 329th month. This plan will last you about

years, or until you're 95 years old.

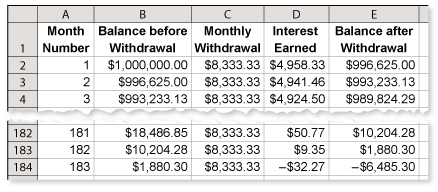

years, or until you're 95 years old. - A spreadsheet showing this plan is shown below.

The balance will run out during the 183rd month. This plan will last you a little over 15 years, or until you're 83 years old.

Sample answer:

I would choose option A. It pays a sufficient amount and would allow me to live to be 93 which is about 10 years longer than my life expectancy would be. If I was getting pretty old and was still in good health I would consider reducing my withdrawals so the account would last longer. If I had the option, instead of one of these retirement plans I would choose one that allowed for increasing withdrawals to account for inflation.

- A spreadsheet showing this plan is shown below.

-

Comments (1)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 1 commentsSubscribe by email Subscribe by RSSRon Larson (author)1 decade ago |A decreasing annuity reminds me of the saying "2 steps forward, 3 steps backward". Each month you withdraw more from the balance than what you earned that month in interest. Eventually, the balance is depleted.0 0