-

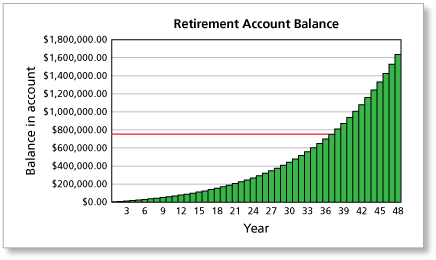

In Example 4, a spreadsheet was used to estimate the balance in the 401(k) plan. There are also many websites that offer retirement calculators such as 401k Planning, AARP, and Bankrate.com.

-

Did you know that 401(k) plans were started by the U.S. Government as a way to encourage Americans to save more money for retirement? To learn about how 401(k) plans work check out this article at How Stuff Works, where you can also watch a video with tips on saving for retirement.

-

You will be 59 at the end of 37 years.

The account balance appears to be about $750,000 after 37 years. So with interest the total balance at the end of the year will be about

-

Comments (2)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 2 commentsSubscribe by email Subscribe by RSSGuest 8 years ago |FART0 0Ron Larson (author)1 decade ago |401(k) funds are typically invested in the stock market. Normally, the owner of the plan is not guaranteed a specific rate of return. Instead, the rate at which the investment grows depends on the stock market. During times of recession or depression, your retirement fund can actually lose value. I remember during one recession the value of my 401(k) dropped by 25%. Fortunately, most of that loss was regained the following year.1 1