-

Note that a Monthly Payment Calculator is located in Tools.

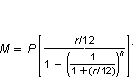

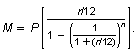

In Example 1, the monthly payment formula from Section 6.2 is used. Recall that the monthly payment M for an installment loan with a principal of P taken out for n months at an annual percentage rate of r (in decimal form) is

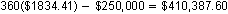

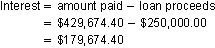

To find the interest in Example 1, note that the home mortgage is for $250,000.

-

Do you want to know what kind of house you can afford? Visit CNN Money for a home affordability calculator based on your salary and savings.

-

-

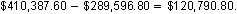

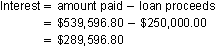

When the annual percentage rate is 8%, your monthly payment will be

That means you pay

in interest. So, the increase in interest paid when the APR goes from 6% to 8% is

in interest. So, the increase in interest paid when the APR goes from 6% to 8% is

-

No, if the interest you pay doubled when APR doubled in general, then it would have done so in the last example.

-

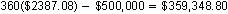

Yes, if the principal changes from $250,000 to $500,000, and the APR is still 4%, then your monthly payment will be

That means you pay

in interest. This is twice what you paid in interest when the principal was $250,000.

in interest. This is twice what you paid in interest when the principal was $250,000. -

Yes. The monthly payment formula is

If the principal doubles, the P in the monthly payment formula will double causing the monthly payment itself to double. Because you will be paying that monthly payment for the same term length, the total amount of money paid will double. Total interest paid is the difference between the total amount paid and the principal. Because the total amount of money paid and principal both double and the total interest paid is the difference between those two, the total interest paid also doubles.

-

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.

1. Negotiate for a smaller purchase price.

2. Negotiate for a lower interest rate.

3. Make a larger down payment.

4. Choose a shorter term for the mortgage.

5. Make extra principle payments.