-

You borrow $4200 from a relative on January 5, 2012, to buy solar panels for your roof and windows with insulated glazing. The annual percentage rate is 8.9%. You agree to repay the loan on May 25, 2012.

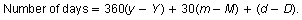

Simple interest based on a 360-day year in which each month has 30 days is called ordinary simple interest. When using ordinary simple interest, you can use the formula below to find the number of days in a term from a month M, day D, and year Y to a later month m, day d, and year y. (Note: January = 1, February = 2, etc.)

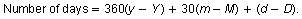

- Use the formula to find the number of days in the term.

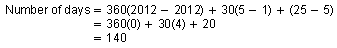

- Find the total amount due using ordinary simple interest.

-

a. In the formula, January =1 and May = 5.

b. The interest is

So, the total amount due is

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

You borrow $4200 from a relative on January 5, 2012, to buy solar panels for your roof and windows with insulated glazing. The annual percentage rate is 8.9%. You agree to repay the loan on May 25, 2012.

What is the actual number of days in the term? Find the total amount due using exact simple interest, as on page 256.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Simple interest based on a 360-day year in which each month has 30 days is called ordinary simple interest. When using ordinary simple interest, you can use the formula below to find the number of days in a term from month M, day D, year Y to a later month m, day d, and year y. (Note: January = 1, February = 2, etc.)

Which type of interest costs you more money? Will this always be true? Explain.

-

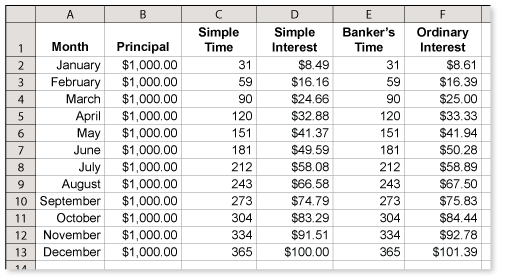

To determine which type of interest costs more, you can use a spreadsheet.

For simplicity, use a principal of $1000 and an annual interest rate of 10%. Notice that the formula for ordinary interest yields slightly more interest than the formula for simple interest. This is true until the end of the year, when both formulas yield the same amount of interest.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Do you think it is appropriate to use ordinary simple interest as an approximation of exact simple interest? Explain.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

The Banker's Rule is another type of simple interest that is similar to ordinary simple interest. It is based on a 360-day year, but you use the actual number of days in the term when calculating interest. Does this benefit the lender or the borrower? Explain.

-

To determine who benefits more, you can use a spreadsheet.

For simplicity, use a principal of $1000 and an annual interest rate of 10%. Notice that the formula using Banker's Rule yields slightly more interest than the formula for simple interest. So, the lender benefits more.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

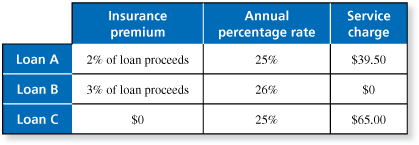

You have 3 loan options for borrowing $2500. You will repay the simple interest loan in 180 days.

- Find the interest for each loan.

- Find the annual percentage rate of each loan, including the service charge.

- Find the total amount due for each loan.

- Which loan would you choose? Explain

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.