-

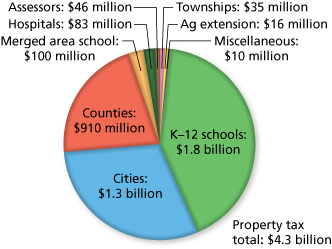

The circle graph shows the types of property taxes collected in a state in one year. What percent of the property taxes went to K-12 schools? See Example 5.)

-

From the circle graph, it appears that about 40% of the property taxes went to K-12 schools.

You can check this using division.

So, about 42% of the property taxes went to K-12 schools.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

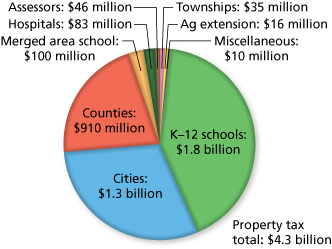

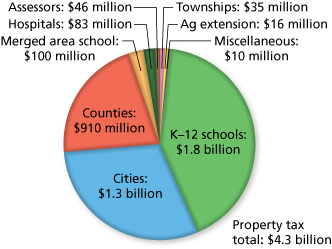

The circle graph shows the types of property taxes collected in a state in one year. Without the military exemption, the state would have collected about 0.06% more in property taxes. Estimate the total military exemption. (See Example 5.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

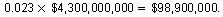

The circle graph shows the types of property taxes collected in a state in one year. Without the homestead tax credit, the state would have collected about 2.3% more in property taxes. Estimate the total property taxes that would have been collected without the homestead tax credit. (See Example 5.)

-

2.3% of $4.3 billion is

So, without the homestead tax credit, the county could have collected a total of

in property taxes.

in property taxes.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

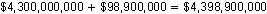

In New York, veterans of the following conflicts can receive property tax exemptions on their primary residence, as detailed in the table.

- Persian Gulf War

- Vietnam War

- Korean War

- World War II

- World War I

- Mexican Border Period

A veteran of the Korean War did not serve in a combat zone and is not disabled. He applies for the military exemption. The assessed value of his Class 1 home is $150,000. How much does he save on property taxes when the tax rate is 85 mills? (See Example 6.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

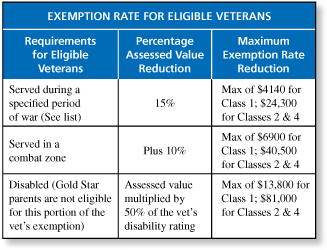

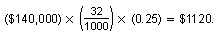

In New York, veterans of the following conflicts can receive property tax exemptions on their primary residence, as detailed in the table.

- Persian Gulf War

- Vietnam War

- Korean War

- World War II

- World War I

- Mexican Border Period

A non disabled veteran of the Persian Gulf War who served in a combat zone applies for the military exemption. The assessed value of her Class 2 property is $140,000. How much does she save on property taxes when the tax rate is 32 mills? (See Example 6.)

-

The verteran will save

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Texas offers a property tax exemption on qualifying wind and solar power energy devices, such as the solar hot water system shown. These devices generally increase the assessed value of a home. This increase is the amount of the exemption. (See Example 6.)

- After installation of the hot water system, the assessed value of a home increases by $15,000 to a total of $175,000. How much is the exemption?

- The county tax rate is 9 mills. How much does the exemption save the homeowner in county taxes?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.