-

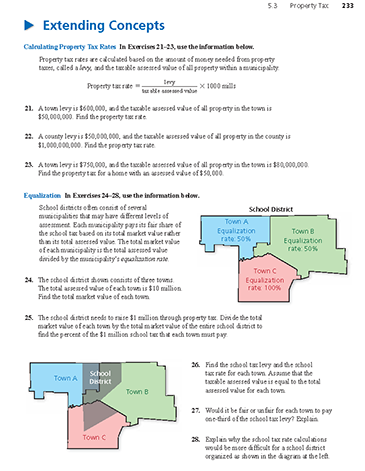

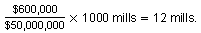

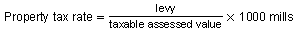

Property tax rates are calculated based on the amount of money needed from property taxes, called a levy, and the taxable assessed value of all property within a municipality.

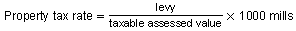

A town levy is $600,000, and the taxable assessed value of all property in the town is $50,000,000. Find the property tax rate.

-

The property tax rate is

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

Property tax rates are calculated based on the amount of money needed from property taxes, called a levy, and the taxable assessed value of all property within a municipality.

A county levy is $50,000,000, and the taxable assessed value of all property in the county is $1,000,000,000. Find the property tax rate.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

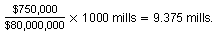

Property tax rates are calculated based on the amount of money needed from property taxes, called a levy, and the taxable assessed value of all property within a municipality.

A town levy is $750,000, and the taxable assessed value of all property in the town is $80,000,000. Find the property tax for a home with an assessed value of $50,000.

-

The property tax rate is

The property tax for a home with an assessed value of $50,000 is

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

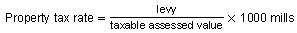

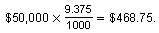

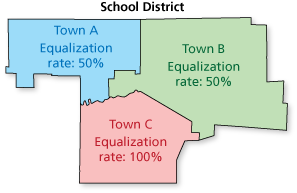

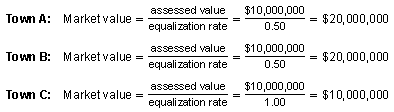

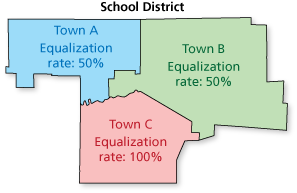

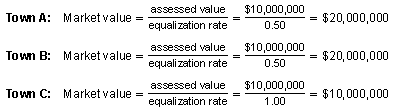

School districts often consist of several municipalities that may have different levels of assessment. Each municipality pays its fair share of the school tax based on its total market value rather than its total assessed value. The total market value of each municipality is the total assessed value divided by the municipality's equalization rate.

The school district shown consists of three towns. The total assessed value of each town is $10 million. Find the total market value of each town.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

School districts often consist of several municipalities that may have different levels of assessment. Each municipality pays its fair share of the school tax based on its total market value rather than its total assessed value. The total market value of each municipality is the total assessed value divided by the municipality's equalization rate.

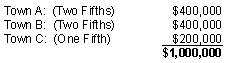

The school district shown consists of three towns. The total assessed value of each town is $10 million. The school district needs to raise $1 million through property tax. Divide the total market value of each town by the total market value of the entire school district to find the percent of the $1 million school tax that each town must pay.

-

You can find the market value of each town as follows.

Each town's fair share of the $1,000,000 is as follows.

So, Town A and Town B each pay 40% of the school taxes, and Town C pays 20%.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

School districts often consist of several municipalities that may have different levels of assessment. Each municipality pays its fair share of the school tax based on its total market value rather than its total assessed value. The total market value of each municipality is the total assessed value divided by the municipality's equalization rate.

Find the school tax levy and the school tax rate for each town. Assume that the taxable assessed value is equal to the total assessed value for each town.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

School districts often consist of several municipalities that may have different levels of assessment. Each municipality pays its fair share of the school tax based on its total market value rather than its total assessed value. The total market value of each municipality is the total assessed value divided by the municipality's equalization rate.

The school district shown consists of three towns. The total assessed value of each town is $10 million. The school district needs to raise $1 million through property taxes. Would it be fair or unfair for each town to pay one-third of the school tax levy? Explain.

-

In Exercise 25, you discovered that the market values of the 3 towns are not equal.

Your answer as to whether each town should contribute the same amount depends on your own political philosophy.

- A very conservative philosophy might argue that each family should contribute to property taxes according to the level at which the family uses municipal services. For instance, families with several children would be billed more for school taxes than families with fewer children.

- A very liberal philosophy might argue that families with greater incomes (and greater property values) should pay the lion's share of all taxes ... property taxes, income taxes, and other taxes.

- A typical "American philosophy" about property taxes (for schools, fire protection, police protection, and other municipal services) is that all citizens benefit from a high quality free public education. Because families with low incomes simply cannot be taxed much (you can't get blood out of a turnip), the tax liability tends to fall on those who do have money.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

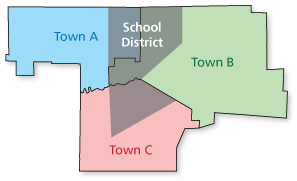

School districts often consist of several municipalities that may have different levels of assessment. Each municipality pays its fair share of the school tax based on its total market value rather than its total assessed value. The total market value of each municipality is the total assessed value divided by the municipality's equalization rate.

Explain why the school tax rate calculations would be more difficult for a school district organized as shown in the diagram.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.