-

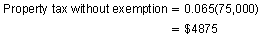

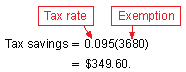

Another way to determine the tax savings in Example 6 is to first calculate the property tax without the exemption.

Next, subtract the property tax found in Example 6 to obtain

This matches the tax savings found in Example 6.

-

Looking for more information on tax exemptions or taxes in general? Visit the IRS website for useful information, forms, and more.

-

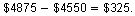

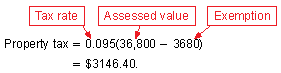

The amount of the exemption is

This is under the maximum, so the exemption is $3680.

The property tax is

The tax savings from the $3680 reduction in the assessed value is

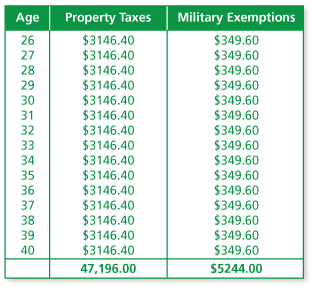

The veteran pays $3146.40 in property tax each year and saves $349.60 from

the exemption each year.

From age 26 to age 40, the veteran pays $47,196.00 in property taxes and saves $5244.00 from the exemption.

-

Comments (1)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 1 commentsSubscribe by email Subscribe by RSSGuest 1 decade ago |The National Taxpayers Union has estimated that over 60% of properties in the United States are assessed too high. People are paying too much in property taxes. However, despite these growing property tax bills, less than half of homeowners will ever protest their assessments. That means most people are needlessly paying more in property taxes than necessary. The bottom line is that the appeal process is not as challenging as many homeowners fear.0 1