-

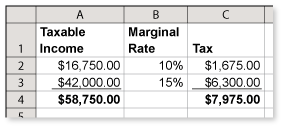

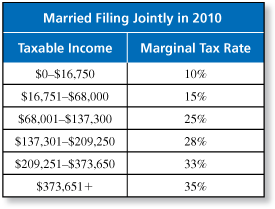

The table shows the marginal tax rates for a married couple filing jointly. You and your spouse have a taxable income of $58,750. How much do you pay in income tax? What is the effective tax rate? (See Example 1 and Example 2)

-

Use a spreadsheet to calculate the tax liability.

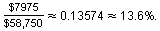

So, you owe $7975 in income tax. This means that your effective tax rate is

Comments (1)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 1 commentsSubscribe by email Subscribe by RSSGuest 3 years ago |Ah, math.. My oldest rival..1 1 -

-

The table shows the marginal tax rates for a married couple filing jointly. You and your spouse have a taxable income of $75,000. Compare your income tax with that of a single taxpayer who has the same taxable income. (See Example 1 and Example 2.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

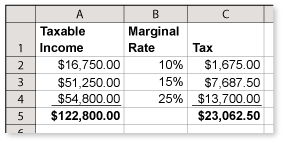

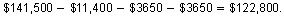

The table shows the marginal tax rates for a married couple filing jointly. You and your spouse have an adjusted gross income of $141,500. You subtract a standard deduction of $11,400 and 2 personal exemptions of $3650 each to determine your taxable income. How much do you pay in income tax? What is the effective tax rate? (See Example 1 and Example 2.)

-

Your taxable income is

Use a spreadsheet to calculate your tax liability.

So, you owe $23,062.50 in income tax. This means that your effective tax rate is

Note that by definition, the effective tax rate uses the taxable income, not the gross income, as the base.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

The table shows the marginal tax rates for a married couple filing jointly. You have an adjusted gross income of $214,000, and your spouse has no income. (See Example 1 and Example 2.)

- You subtract a standard deduction of $11,400 and 2 personal exemptions of $3650 each to determine your taxable income. How much do you pay in income taxes? What is the effective tax rate?

- The standard deduction for a taxpayer filing "single" is $5700, and the personal exemption is $3650. Suppose you are single and subtract the standard deduction and personal exemption to determine your taxable income. How much more do you pay in income tax than in part (a)? How much higher is the effective tax rate?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

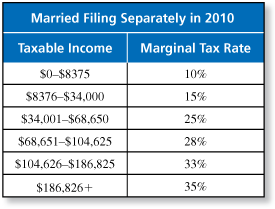

The tables show the marginal tax rates for a married couple filing separately and filing jointly.

You and your spouse have a taxable income of $54,680. Do you pay less tax to file all the income for yourself under "married filing separately" rather than "married filing jointly"? Explain your reasoning. (See Example 1 and Example 2.)

-

In the "married filing separately" table, you can see that this would push your income up to a marginal tax rate of 25%. If you filed under "married filing jointy," your maximum marginal rate would be 15%. So, you would pay less tax to file under "married filing jointly."

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Do incomes in the same bracket have the same effective tax rate? Explain your reasoning. (See Example 1 and Example 2.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.