-

On page 212, the table showing the graduated income tax for the taxable income of a single person in 2010 has been simplified from the actual table used. For instance, the first row in the IRS 2010 tax tables essentially says, "If your taxable income is over $0 but not over $8375, then the tax is 10% of the amount over $0." What is the marginal tax rate for a taxable income of $8375.25? For the amount of $8375, it would be taxed at the 10% rate, and the remaining $0.25 would be taxed at the 15% rate.

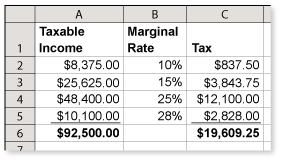

To make a spreadsheet similar to the one in Example 1(a), use the steps below.

- Enter the titles "Taxable Income," "Marginal Tax Rate," and "Tax," into row 1

- Enter 8375 into cell A2, = 34000 − 8375 into cell A3, and = 67850 − 34000 into cell A4.

- Enter the formula = SUM(A2:A4) into cell A5.

- Enter 0.1 into cell B2, 0.15 into cell B3, and 0.25 into cell B4.

- Enter the formula = A2*B2 into cell C2.

- Select cell C2. From the Edit menu, choose Copy.

- Select cells C3 and C4. From the Edit menu, choose Paste.

- Enter the formula = SUM(C2:C4) into cell C5.

To format the cells, use the steps below.

- Select cells A2 through A5.

- From the Format menu, choose Cells....

- In the Format Cells dialog, select the Number tab.

- From the Category: list, select Currency.

- For Decimal places:, enter 2. For Symbol, choose $ from the drop down list. Then click OK.

- Select cells B2 through B4.

- From the Format menu, choose Cells....

- In the Format Cells dialog, select the Number tab.

- From the Category: list, select Percentage.

- For Decimal places:, enter 0. Then click OK.

- Select cells B2 through B5. Repeat Steps 2 through 5.

-

Do you want to know exactly how much you pay in taxes? Use the 2011 tax table from the Internal Revenue Service to find out.

-

Use a spreadsheet to calculate the income tax owed.

The federal income tax is $19,609.25.

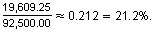

The effective tax rate is

-

Comments (2)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 2 commentsSubscribe by email Subscribe by RSSGuest 1 decade ago |It rankles me that the current graduated tax rates (35% maximum) are called the "Bush Tax Cut Rates". In fact, these are the "Reagan Tax Cut Rates" passed during the Reagan Era. It was during Clinton's presidency that the rates were increased to 40%. George W. Bush simply restored the rates to what they had been during Reagan's presidency. I wish that the media in the United States would quit talking about "eliminating the Bush Tax Cuts for the rich" and at least call a spade a spade and talk about "reinstating the Clinton Tax Increases against the rich".1 1Guest 1 decade ago |Here is an interesting opinion written by a tax attorney. "What can you do to reduce your chances of being prosecuted? What is the one rule all taxpayers should never forget? ALWAYS file your tax returns on time – EVEN if you don’t have the money to pay the tax! Why? Remember – its not a crime to owe the IRS, just a crime to not file the tax returns. Also, if you file your tax return, even if you owe taxes, it prevents a large penalty from being applied - the failure to file penalty. "1 1