-

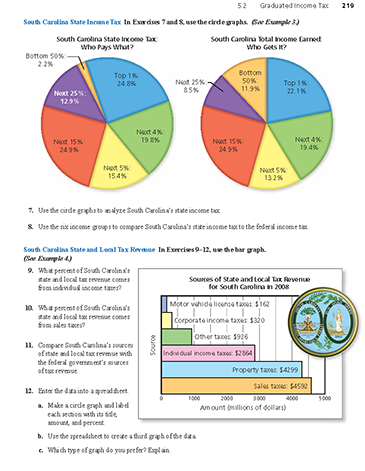

Use the circle graphs to analyze South Carolina's state income tax. (See Example 3.)

-

South Carolina's state income tax is a graduated income tax system that is similar to the federal income tax system in the United States. The top 25% of all wage earners in South Carolina pay

of all income tax paid to South Carolina. When comparing this to all income, this seems equitable because the top 25% of all wage earners in South Carolina earn

of all the income.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

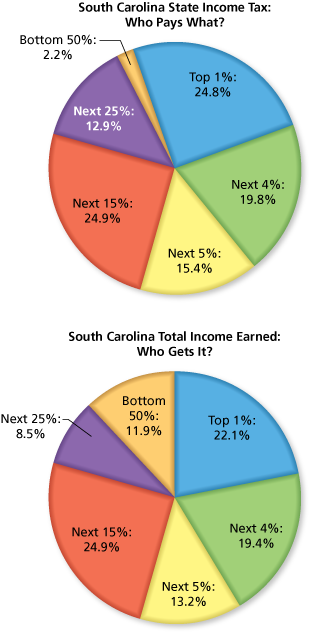

Use the six income groups to compare South Carolina's state income tax to the federal income tax. (See Example 3)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

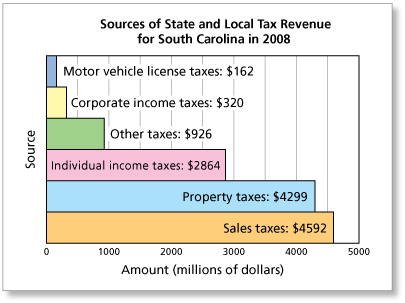

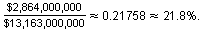

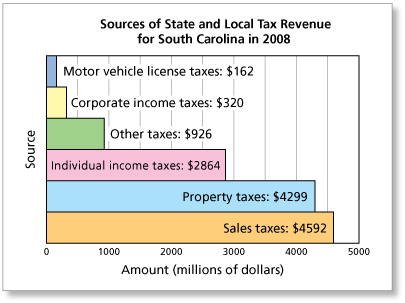

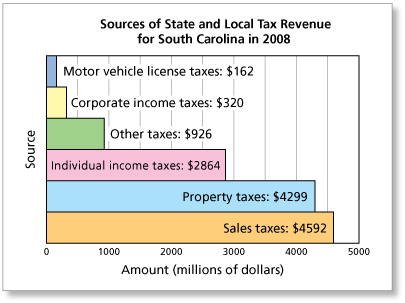

What percent of South Carolina's state and local tax revenue comes from individual income taxes? (See Example 4.)

-

Add the values in the graph to find the total tax revenue for South Carolina in 2008.

This implies that the percent derived from individual income tax is

So, South Carolina derives about 22% of its tax revenue from individual income taxes.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

What percent of South Carolina's state and local tax revenue comes from sales taxes? (See Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

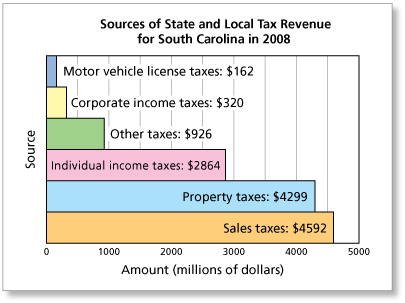

Compare South Carolina's sources of state and local tax revenue with the federal government's sources of tax revenue. (See Example 4.)

-

The sources of revenue for the two governments are quite different.

- The 2 largest sources of tax revenue for South Carolina are property taxes and sales taxes. The federal government doesn't collect either of these taxes.

- The 2 largest sources of tax revenue for the federal government are Social Secuirty & Medicare taxes and individual income taxes. South Carolina does collect an income tax, but it does not collect Social Security or Medicare taxes.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Enter the data into a spreadsheet. (See Example 4.)

- Make a circle graph and label each section with its title, amount, and percent.

- Use the spreadsheet to create a third graph of the data.

- Which type of graph do you prefer? Explain.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.