-

Determine whether the tax is regressive, flat, or progressive. Explain your reasoning. (See Example 3.)

Social Security tax of 6.2% on earnings up to $106,800

-

Social Security taxes are regressive because they apply only to earnings up to a certain amount. In 2011, the maximum Social Security tax paid by an employee was 6.2% of $106,800.

(A self-employed person would have paid a maximum of twice this amount.)

If an employed person earned $200,000, he or she would still have paid only $6621.60, which means that the percent paid on total income would be less than 6.2%. This implies that the tax is regressive.

From its inception, Social Security tax has been regressive. In 1994, however, Medicare tax was split off from Social Security tax. At that time, the income cap on Medicare was removed, making it a flat tax.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

Determine whether the tax is regressive, flat or progressive. Explain your reasoning. (See Example 3.)

17% income tax on all income over $12,500

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Determine whether the tax is regressive, flat, or progressive. Explain your reasoning. (See Example 3.)

19% income tax on all income

-

This is a flat tax because it is the same percent on all income.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Determine whether the tax is regressive, flat or progressive. Explain your reasoning. (See Example 3.)

7% sales tax

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

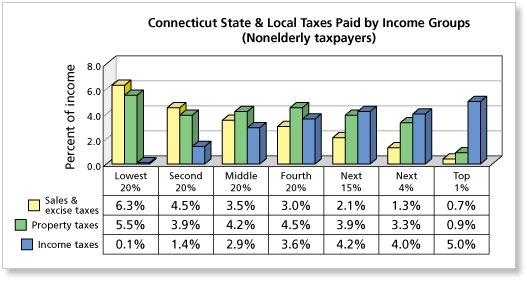

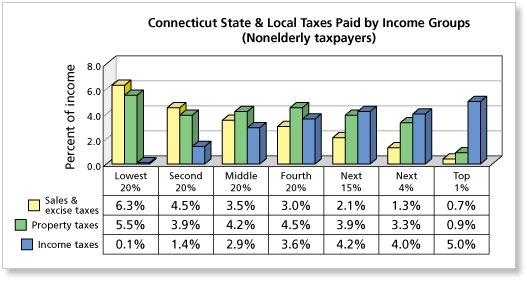

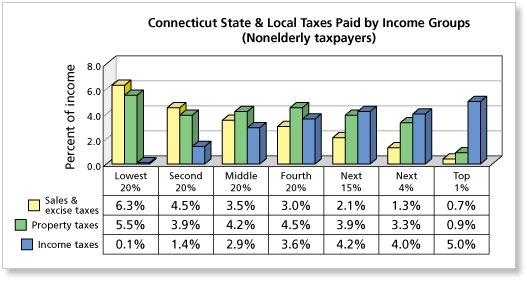

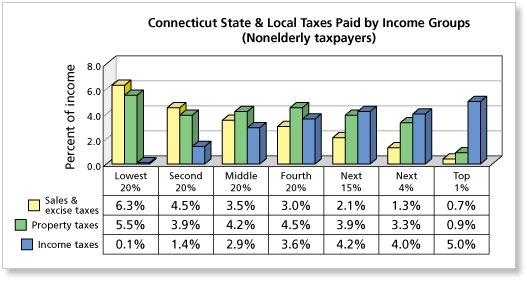

The income for a family in the middle 20% is $58,000. How much, in dollars, does this family pay for each type of tax? (See Example 4.)

-

For a family with an income of $58,000, the taxes are as follows.

Sales & excise taxes:

Property taxes:

Income taxes:

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

The income for a family in the top 1% is $3,160,000. How much, in dollars, does this family pay for each type of tax? (See Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Determine whether the three types of taxes are regressive, flat, or progressive in Connecticut. Explain your reasoning. (See Example 4.)

-

Sales & excise taxes: The rate decreases as income increases. These taxes are regressive.

Property taxes: The rate decreases as income increases. These taxes are regressive.

Income taxes: The rate increases as income increases. These taxes are progressive.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Are taxes, as a whole, regressive, flat, or progressive in Connecticut? Explain your reasoning.(See Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.