-

The state of Hawaii does not have a sales tax. Instead, it has a general excise tax. Unlike a sales tax, the general excise tax applies to businesses, not customers. Hawaii taxes retailers at a rate of 4% on gross income from business transactions.

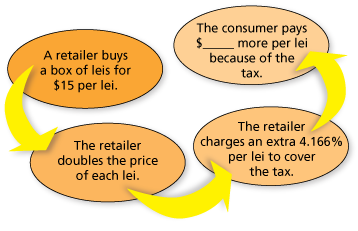

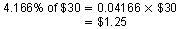

Complete the diagram. Explain your reasoning. (See Example 5.)

-

- The original price per lei is $15.

- The retailer adds $15 per lei for a price of $30 per lei.

- The retailer adds 4.166% to the price of each lei.

4.The customer pays $31.25 per lei. Of this, $1.25 is the general excise tax.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

The state of Hawaii does not have a sales tax. Instead, it has a general excise tax. Unlike a sales tax, the general excise tax applies to businesses, not customers. Hawaii taxes retailers at a rate of 4% on gross income from business transactions.

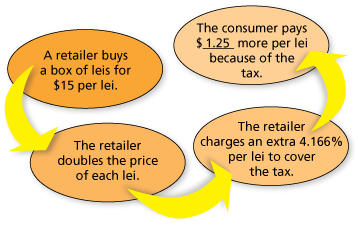

Complete the diagram. Explain your reasoning. (See Example 5.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

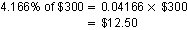

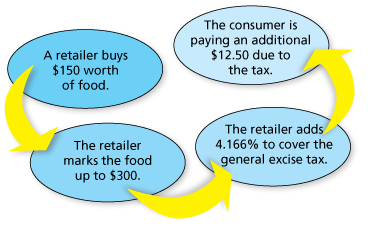

The state of Hawaii does not have a sales tax. Instead, it has a general excise tax. Unlike a sales tax, the general excise tax applies to businesses, not customers. Hawaii taxes retailers at a rate of 4% on gross income from business transactions.

A retailer purchases $150 worth of food. Draw a diagram showing a chain of events that could occur. Is the tax regressive, flat, or progressive? Explain. (See Example 5.)

-

Here is one possible chain of events.

- The original price of the food is $150.

- To cover expenses and make a profit, the retailer doubles the price.

- The retailer adds 4.166% to the price.

4.The customer pays $312.50 for the food. Of this, $12.50 is due to the general excise tax.

This is a regressive tax.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

The state of Hawaii does not have a sales tax. Instead, it has a general excise tax. Unlike a sales tax, the general excise tax applies to businesses, not customers. Hawaii taxes retailers at a rate of 4% on gross income from business transactions.

A retailer purchases $70 worth of medicine. Draw a diagram showing a chain of events that could occur. Is the tax regressive, flat, or progressive? Explain. (See Example 5.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

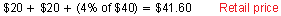

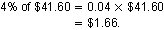

A business passes on the general excise tax to the consumer as a charge that is a percent of the retail price. The charge is also subject to the general excise tax. The business cannot charge more than 4.166% of the retail price because consumer protection laws prohibit businesses from passing on an amount that exceeds the general excise tax on a transaction. Explain why the percent is 4.166%, not 4%. (See Example 5.)

-

The retail price of an item is composed of 3 parts.

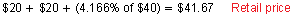

The problem is that the state requires a general excise tax of 4% on the entire retail price. Let's look at an example.

The general excise tax is

So, by charging only 4% of $40, the retailer did not charge enough to cover what it has to pay in general excise tax, which is $1.66. To compensate for this, retailers are allowed to add 4.166% of their marked-up price.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

The island of Oahu adds an extra 0.5% surcharge to the general excise tax to fund its mass transit system. Discuss ways in which the tax might help the people who are paying it. (See Example 6.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.