-

Determine how much state income tax the person owes. (See Example 1.)

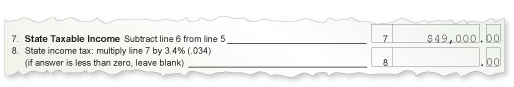

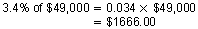

A person who lives in Indiana has a taxable income of $49,000.

-

Line 7 on the state income tax form is $49,000.

The state income tax is 3.4% of Line 7.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

Determine how much state income tax the person owes. (See Example 1.)

A person who lives in Indiana has a taxable income of $2,500,000.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Determine how much state income tax the person owes. (See Example 1.)

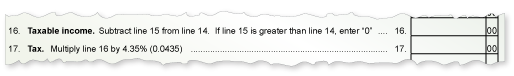

A person who lives in Michigan has a taxable income of $25,000.

-

Line 16 on the state income tax form is $25,000.

The state income tax is 4.35% of Line 16.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Determine how much state income tax the person owes. (See Example 1.)

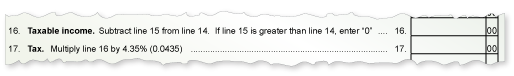

A person who lives in Michigan has a taxable income of $60,000.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Use the Internet to determine whether the income is taxable by the federal government. (See Example 2.)

$100 gift card you receive from your parents

-

According to current IRS tax regulations, taxpayers are allowed to give and receive small amounts without paying tax. Therefore, the $100 is not taxable.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Use the Internet to determine whether the income is taxable by the federal government. (See Example 2.)

$2000 per year scholarship you receive for college tuition

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Use the Internet to determine whether the income is taxable by the federal government. (See Example 2.)

$ 250 bonus you receive from your employer

-

Any bonuses or awards received by an employer are taxable. This also applies to noncash prizes such as vacations or other goods and services.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Use the Internet to determine whether the income is taxable by the federal government. (See Example 2.)

$5000 prize you receive from a game show

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.