-

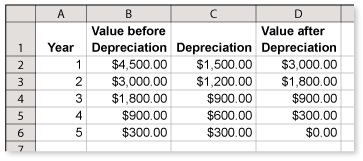

The owner of a restaurant buys new kitchen equipment.

Cost: $4500

Salvage value: $0

Useful life: 5 years

Make a sum of the years-digits depreciation schedule for the equipment. (See Example 5.)

A spreadsheet is available to help you complete this exercise.

-

A sum of the years-digits depreciation schedule for the equipment is shown in the spreadsheet below.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

The owner of a restaurant buys new kitchen equipment.

Cost: $400

Salvage value: $50

Useful life: 7 years

Make a sum of the years-digits depreciation schedule for the equipment. (See Example 5.)

A spreadsheet is available to help you complete this exercise.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

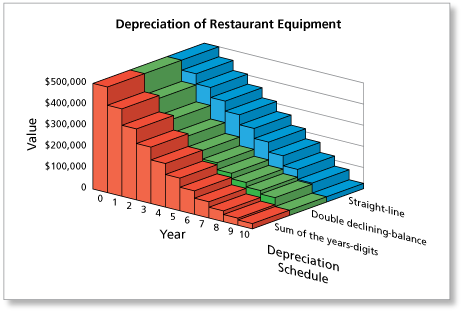

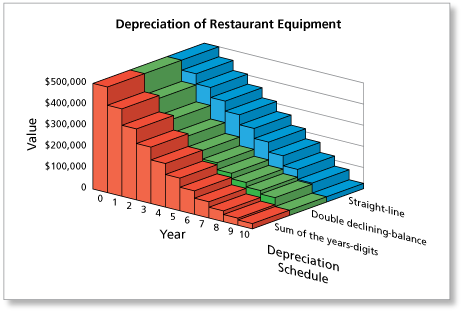

The owner of a restaurant buys new equipment. The salvage value of the equipment is $25,000.

The graph shows three methods that the restaurant can use to depreciate the equipment.

Which method depreciates the value the most during the first 3 years? (See Example 6.)

-

From the graph, you can see that after 3 years, the green graph is the lowest. Therefore, the double declining-balance method depreciates the most during the first 3 years.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

The owner of a restaurant buys new equipment. The salvage value of the equipment is $25,000. The graph shows three methods that the restaurant can use to depreciate the equipment. Which method depreciates the value the most during years 4 through 10? (See Example 6.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

The owner of a restaurant buys new equipment. The salvage value of the equipment is $25,000. The graph shows three methods that the restaurant can use to depreciate the equipment. Using sum of the years-digits depreciation, how much more of the value did the restaurant expense during the first 4 years when compared to straight-line depreciation? (See Example 6.)

-

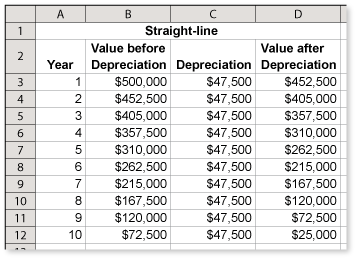

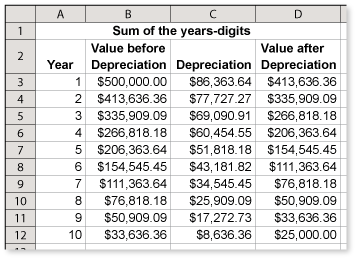

From the graph, you can see that the sum of the years-digits method depreciated about $100,000 more during the first 4 years than the straight-line method. To check this estimate, you can compare the depreciation schedules for the two methods.

From the spreadsheets, you can see that the straight-line method depreciated

during the first 4 years. The sum of the years-digits method depreciated

during the first 4 years. The difference is $103,636.36.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 3 commentsCody (moderator)1 decade ago |Michelle,

We have looked at the spreadsheet and found that there was an error in the data. The problem was fixed and the new spreadsheet was posted to the site.

Thank you.0 0Cody (moderator)1 decade ago |Thank you for letting me know. I will take a look into this spreadsheet as well.0 0Guest 1 decade ago |Again, the spreadsheet is incorrect in the depreciation column of the Single-Line Depreciation method.

Michelle Swenson

Math Teacher

Ray High School, ND0 0 -

-

The owner of a restaurant buys new equipment. The salvage value of the equipment is $25,000. The graph shows three methods that the restaurant can use to depreciate the equipment. Suppose the restaurant sells the equipment for $250,000 after 4 years. Describe the restaurant's gain or loss using each method. (See Example 6.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 3 commentsCody (moderator)1 decade ago |Michelle,

We have fixed the error in this spreadsheet as well. The updated spreadsheet was posted to the site.

Thank you.0 0Cody (moderator)1 decade ago |I will look into this spreadsheet as well. Thank you.0 0Guest 1 decade ago |The data seems to be incorrect when entered into the spreadsheet for everything but the sum of the years-digit column.

Michelle Swenson

Math Teacher

Ray High School, ND0 0