-

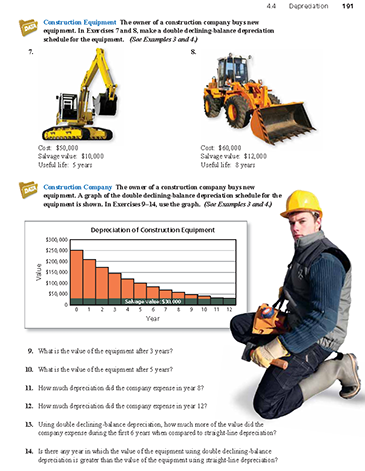

The owner of a construction company buys new equipment.

Cost: $50,000

Salvage value: $10,000

Useful life: 5 years

Make a double declining-balance depreciation schedule for the equipment. (See Example 3 and Example 4.)

A spreadsheet is available to help you complete this exercise.

-

The annual rate of depreciation is

A spreadsheet showing the depreciation schedule is shown below.

Notice that the equipment is fully depreciated after 4 years.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

The owner of a construction company buys new equipment.

Cost: $60,000

Salvage value: $12,000

Useful life: 8 years

Make a double declining-balance depreciation schedule for the equipment. (See Example 3 and Example 4.)

A spreadsheet is available to help you complete this exercise.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

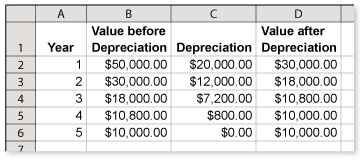

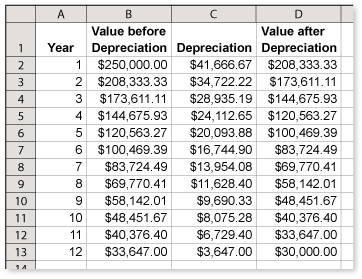

The owner of a construction company buys new equipment. A graph of the double declining-balance depreciation schedule for the equipment is shown. What is the value of the equipment after 3 years? (See Example 3 and Example 4.)

-

From the graph, the value after 3 years appears to be about $145,000.

You can check this by making a depreciation schedule.

The annual rate of depreciation is

A spreadsheet showing the depreciation schedule is shown below.

From the schedule, you can see that the value after 3 years is $144,675.93.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

The owner of a construction company buys new equipment. A graph of the double declining-balance depreciation schedule for the equipment is shown. What is the value of the equipment after 5 years?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

The owner of a construction company buys new equipment. A graph of the double declining-balance depreciation schedule for the equipment is shown. How much depreciation did the company expense in year 8? (See Example 3 and Example 4.)

-

From the graph, it is difficult to tell how much was depreciated in Year 8. It appears to have been about $10,000.

You can check this by making a depreciation schedule.

The annual rate of depreciation is

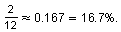

A spreadsheet showing the depreciation schedule is shown below.

From the schedule, you can see that the amount that was depreciated in Year 8 was $11,628.40.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

The owner of a construction company buys new equipment. A graph of the double declining-balance depreciation schedule for the equipment is shown. How much depreciation did the company expense in year 12? (See Example 3 and Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

The owner of a construction company buys new equipment. A graph of the double declining-balance depreciation schedule for the equipment is shown. Using double declining-balance depreciation, how much more of the value did the company expense during the first 6 years when compared to straight-line depreciation? (See Example 3 and Example 4.)

-

The annual rate of depreciation is

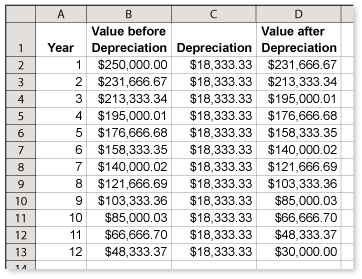

A spreadsheet showing the double declining-balance depreciation schedule is shown below. During the first 6 years, the company depreciated $166,275.51 of the purchase price of the equipment.

Double Declining-Balance Depreciation Schedule

A spreadsheet showing the straight-line depreciation schedule is shown below. During the first 6 years, the company depreciated about $110,000 of the purchase price of the equipment.

Straight-Line Depreciation Schedule

Note: When working with spreadsheets and depreciation, the entries for each year can vary by a few cents, depending on how the spreadsheet is programmed.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 4 commentsRon Larson (author)1 decade ago |Hi Michelle, Thanks for taking the time to post a comment about the data in the spreadsheet. Please encourage your students to help us with any other improvements or corrections to the book. By the way, all four of my grandparents were homesteaders in North Dakota. They lived near a town called Sanish, which was flooded. Some of my cousins still farm the land there.0 0Cody (moderator)1 decade ago |Michelle,

We have looked at the spreadsheet and found that there was an error in the data. The problem was fixed and the new spreadsheet was posted to the site.

Thank you.0 0Cody (moderator)1 decade ago |Thank you for letting me know. I will take a look at the problem and let you know what I find.

-Cody0 0Guest 1 decade ago |The spreadsheet attached to this problem seems to have a wrong formula in Column H - the depreciation. You may want to take a look at it.

Michelle Swenson

Math Teacher

Ray High School, ND0 0 -

-

The owner of a construction company buys new equipment. A graph of the double declining-balance depreciation schedule for the equipment is shown. Is there any year in which the value of the equipment using double declining-balance depreciation is greater than the value of the equipment using straight-line depreciation? (See Example 3 and Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 3 commentsGuest 2 years ago |KUTUN0 0Guest 3 years ago |this is ridiculous.0 0Guest 5 years ago |vimob0 0