-

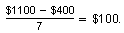

The owner of a hair salon buys new equipment.

Cost: $1100

Salvage value: $400

Useful life: 7 years

Make a straight-line depreciation schedule for the equipment. (See Example 1 and Example 2.)

A spreadsheet is available to help you complete this exercise.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

The owner of a hair salon buys new equipment.

Cost: $14,500

Salvage value: $2500

Useful life: 10 years

Make a straight-line depreciation schedule for the equipment. (See Example 1 and Example 2.)

A spreadsheet is available to help you complete this exercise.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

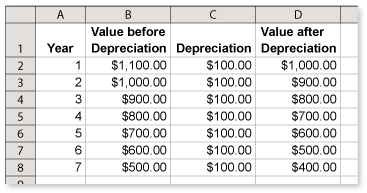

The owner of a barbershop buys new equipment. A graph of the straight-line depreciation schedule for the equipment is shown. What is the value of the equipment after 5 years? (See Example 1 and Example 2.)

-

From the graph, the value after 5 years appears to be about $5000.

You can check this by making a depreciation schedule.

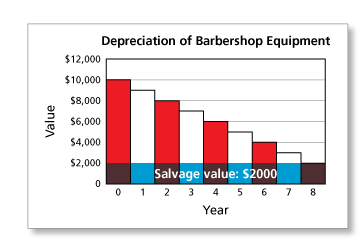

Cost: $10,000

Salvage value: $2000

Useful life: 8 years

The annual depreciation is

A spreadsheet showing the depreciation schedule is shown below.

From the schedule, you can see that the value after 5 years is exactly $5000.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

The owner of a barbershop buys new equipment. A graph of the straight-line depreciation schedule for the equipment is shown. What is the value of the equipment after 7 years?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

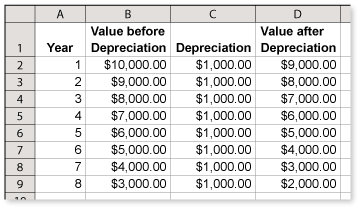

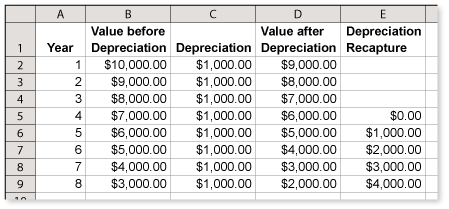

When a business sells equipment at a price greater than its value, the U.S. Internal Revenue Service collects taxes on the difference. This is called depreciation recapture. Find the taxable amount for each year in which depreciation recapture could occur for a selling price of $6000. (See Example 1 and Example 2.)

-

Begin by making a depreciation schedule.

Cost: $10,000

Salvage value: $2000

Useful life: 8 years

The annual depreciation is

After making a depreciation schedule, add a 5th column that shows the excess on which taxes must be paid.

A spreadsheet showing the depreciation schedule is shown below.

So, if the equipment is sold in (or after) Year 5, the business must pay tax on part of the sale price.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 1 commentsGuest 5 years ago |Hi, I would like to ask what's the point of collecting taxes on the difference?0 0 -

-

When a business sells equipment at a price less than its value, the difference is tax deductible. Find the tax deductible amount for each year in which a selling price of $4000 would cause a loss.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.