-

Note that the useful life of an item is an estimate of the number of years before the item must be replaced. It is an estimate because the useful life depends upon such things as frequency of use, care when in use, repair procedures, technology, and durability. The salvage value of an item is the estimated resale, trade-in, or scrap value of the item after its useful life.

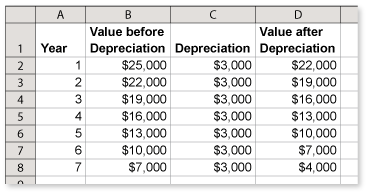

To make a spreadsheet similar to the one in Example 1, use the steps below.

- Enter the titles "Year", "Value before Depreciation", "Depreciation", and "Value after Depreciation " into Row 1.

- Enter 1 into cell A2.

- Enter the formula =A2 + 1 into cell A3.

- Select cell A3. From the Edit menu, choose Copy.

- Select cells A4 through A6. From the Edit menu, choose Paste.

- Enter 25000 into cell B2 and 4000 into cells C2-C6.

- Enter the formula = B2 – C2 into cell D2.

- Select cell D2. From the Edit menu, choose Copy.

- Select cells D3 through D6. From the Edit menu, choose Paste.

- Enter the formula = D2 into cell B3.

- Select cell B3. From the Edit menu, choose Copy.

- Select cells B4 through B6. From the Edit menu, choose Paste.

- Select cells B2 through B6, C2 through C6, and D2 through D6.

- From the Format menu, choose Cells….

- In the Format Cells dialog, select the Number tab.

- From the Category: list, select Currency.

- For Decimal places:, enter 0. For Symbol, choose $ from the drop down list. Then click OK.

-

If you've ever seen the movie Office Space you probably remember the scene where the main characters destroy a fax machine with a baseball bat. Although that looks like fun, there are more practical ways to get rid of office equipment that has depreciated in value or you no longer use. Consider donating old office equipment to Freecycle Network. This is a good way for your company to be green while giving back to the community.

-

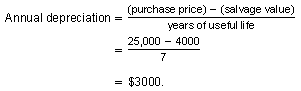

The amount of depreciation each year is

A spreadsheet showing the depreciation schedule is shown below.

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.

>Calculators

> Financial

> Depreciation

> Straight Line Depreciation Calculator