-

-

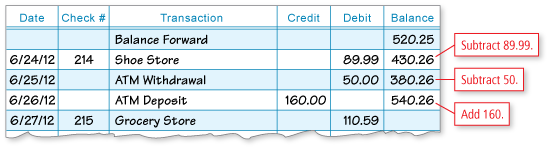

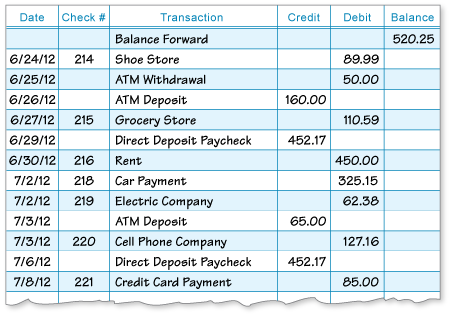

When balancing your checkbook, remember to subtract debits (expenses) and add credits (deposits).

Your balance on 6/26/12 is $540.26.

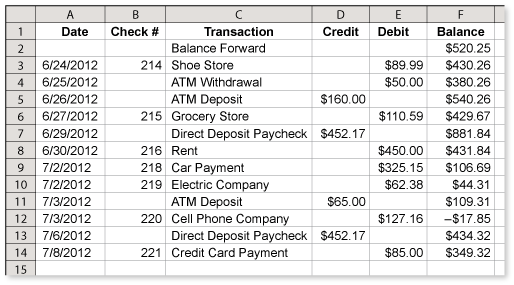

An easy way to check your work is to enter the information in a spreadsheet.

Comments (1)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 1 commentsSubscribe by email Subscribe by RSSGuest 9 months ago |hi0 0 -

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

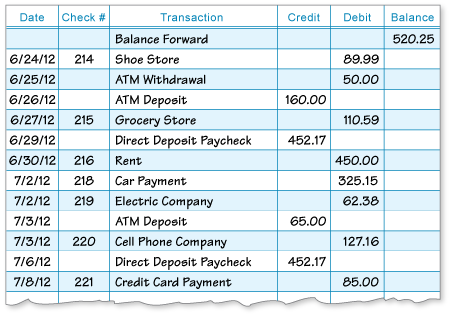

Are there any bad checks shown in your checkbook registry? If so, which checks are bad? (See Example 3 and Example 4.)

-

To determine whether you have any bad checks, complete the entire registry. An easy way to do this is to enter the information into a spreadsheet.

From the spreadsheet, you can see that Check #220 resulted in a negative balance in your account. So, this was a "bad check."

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

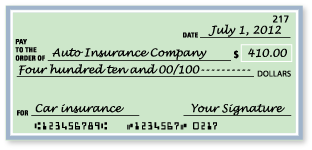

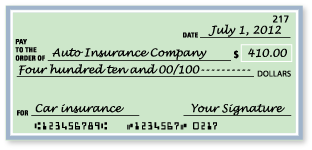

You forget to record check #217 (shown below) in your checkbook registry. Explain the consequences of this omission. (See Example 3 and Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

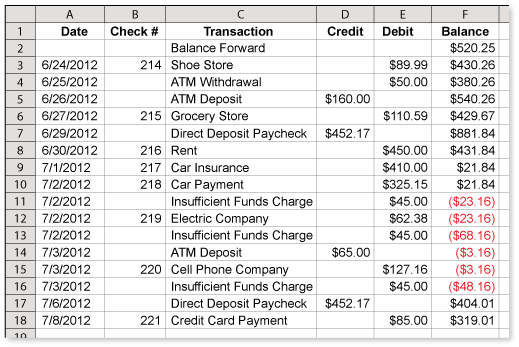

The bad check policy at your bank is to return the bounced check to the vendor and charge your account $45 for each instance. Using the information in Excercise 12, find the actual balance in your checking account as of 7/8/12. (See Example 3 and Example 4.)

-

Because you forgot to record check #217 on 7/1/2012, your account did not have enough funds to cover checks #218, 219, and 220. Your bank returned all three checks and did not deduct the money from your account. Instead, your bank charged you $45 for each check and deducted that amount from your balance.

Your balance as of 7/8/2012 is $319.01. Remember, however, that you have not paid your car payment, electric bill, or cell phone bill.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

In addition to the bank charges in Exercise 13, each vendor shown in your checkbook registry charges a $35 penalty for an insufficient funds check. What is your total cost of bad check fees? (See Example 3 and Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.