-

You want to buy a $100,000 house. You plan to make a $20,000 down payment.

Each month for 5 years, you deposit $300 into a savings account that earns 5%, compounded monthly. After 5 years, you use the money in the account to make the down payment.

- How much is left in the account?

- You leave the remaining amount from part (a) in the account. Assuming you do not make any more deposits, how much is in the account after 14 years?

-

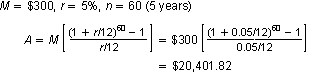

a. Use the formula for the balance in an increasing annuity.

So, after making the down payment of $20,000, you have

left in your account.

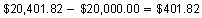

b. Use the formula for compound interest, compounded monthly.

So, at the end of 14 years, you will have a little more than $800 in your account.

Comments (1)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 1 commentsSubscribe by email Subscribe by RSSGuest 6 years ago |f1 0 -

You want to buy a $100,000 house. You plan to make a $20,000 down payment.

You take out a home mortgage for $80,000 for 30 years. Compare the total interest you pay for the annual percentage rates.

a. 5%

b.7%

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

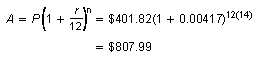

You take out a home mortgage for $80,000 for 30 years at 5.5%. Each month, you make the regular payment of $454.23 plus an additional $50.

- How much sooner do you pay off the mortgage?

- How much do you save in interest?

-

Use a spreadsheet.

- You pay the mortgage off

months (over 6 years) sooner.

months (over 6 years) sooner. -

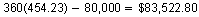

If you had paid monthly payments for 360 months, you would have paid

in interest. By making the additional payments each month, you saved

in interest. This is enough money to buy a nice car!

- You pay the mortgage off

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

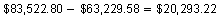

You want to buy a $100,000 house. You plan to make a $20,000 down payment. You take out a home mortgage for $80,000 for 30 years at 6%. After 5 years, you move to a different state and sell the home for $140,250.

Compare the costs of buying the home and renting a comparable home for $550 per month. Assume that if you did not buy the home, you could have invested the down payment and earned $4000 in interest.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

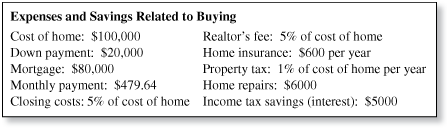

You start your working career when you are 22 years old. Each month, you deposit $150 into a retirement plan that earns 6%, compounded monthly. You continue making deposits into the plan until you are 67 years old.

Find the balance in the account.

-

Use the formula for the balance in an increasing annuity.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

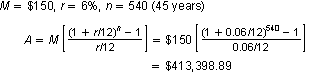

You start your working career when you are 22 years old. Each month, you deposit $150 into a retirement plan that earns 6%, compounded monthly. You continue making deposits into the plan until you are 67 years old.

How many years can the account support withdrawals of $70,000 a year?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.