-

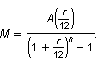

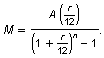

For an increasing annuity, the monthly deposit M that you must make for n months, at an annual percentage rate of r (in decimal form), to achieve a balance of A is

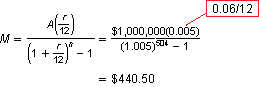

You start saving for retirement at age 25. You want to have $1 million when you retire in 42 years. You invest in a savings plan that earns 6%, compounded monthly.

- How much should you deposit each month?

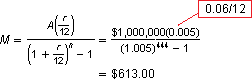

- Suppose you wait until you are 30 to start saving. How much more do you have to deposit each month compared to the amount in part (a)?

-

- Use the formula given above with A = $1,000,000, r = 6%, and n = 12(42) = 504.

- Use the formula given above with A = $1,000,000, r = 6%, and n = 12(37) = 444.

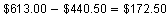

By waiting 5 more years to start your retirement plan, you would need to deposit

more each month to end up with the same balance.

- Use the formula given above with A = $1,000,000, r = 6%, and n = 12(42) = 504.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

For an increasing annuity, the monthly deposit M that you must make for n months, at an annual percentage rate of r (in decimal form), to achieve a balance of A is

You want to have $20,000 to help pay for your child's college education in 18 years. You invest in a savings plan that earns 4.8%, compounded monthly.

- How much should you deposit each month?

- Suppose you want to have the money in 10 years. How much more do you have to deposit each month compared to the amount in part (a)?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

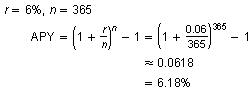

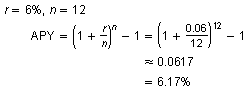

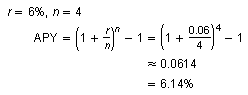

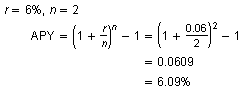

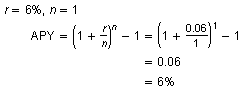

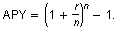

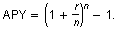

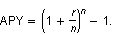

The annual percentage yield (APY) is the rate at which an investment increases each year. The formula for the APY of an investment with an annual percentage rate of r that is compounded n times a year is

Find the APY for an investment that earns 6% for each compounding period.

- a. Daily

- b. Monthly

- c. Quarterly

- d. Semiannually

- e. Annually

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

The annual percentage yield (APY) is the rate at which an investment increases each year. The formula for the APY of an investment with an annual percentage rate of r that is compounded n times a year is

Find the APY for an investment that earns 7% for each compounding period.

- a. Daily

- b. Monthly

- c. Quarterly

- d. Semiannually

- e. Annually

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

The annual percentage yield (APY) is the rate at which an investment increases each year. The formula for the APY of an investment with an annual percentage rate of r that is compounded n times a year is

For what compounding period is the APY the same as the APR? Explain your reasoning.

-

For annual compounding, the annual percentage yield is the same as the annual percentage rate.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

The annual percentage yield (APY) is the rate at which an investment increases each year. The formula for the APY of an investment with an annual percentage rate of r that is compounded n times a year is

Which of the following earns more interest annually?

- An investment with an APY of 6%

- An investment with an APR of 5.9%, compounded monthly

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.