-

You start your working career when you are 22 years old. Each month, you deposit $50 into a pension plan that compounds interest monthly. You continue making deposits into the plan until you are 67 years old. (See Example 3.)

The plan earns 3%. Find the balance in the account.

-

Use the formula for the balance in an increasing annuity.

This is not much of a balance to have after 45 years. What would make more sense is to increase the amount you deposit monthly by the rate of inflation each year. This would have the effect of doubling your balance.

Better yet, if you could get your employer to agree to match your monthly deposit, you would end up with quadruple your balance ... over $228,000.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

You start your working career when you are 22 years old. Each month, you deposit $50 into a pension plan that compounds interest monthly. You continue making deposits into the plan until you are 67 years old. (See Example 3.)

The plan earns 5%. Find the balance in the account.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

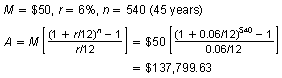

You start your working career when you are 22 years old. Each month, you deposit $50 into a pension plan that compounds interest monthly. You continue making deposits into the plan until you are 67 years old. (See Example 3.)

The plan earns 6%.

- Find the balance in the account.

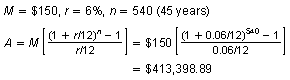

- Suppose that you deposit $150 each month instead of $50. Find the balance in the account.

- Compare the account balances in part (a) and part (b).

-

Use the formula for the balance in an increasing annuity.

- The balance in part (b) is 3 times the balance in part (a).

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You start your working career when you are 22 years old. Each month, you deposit $50 into a pension plan that compounds interest monthly. You continue making deposits into the plan until you are 67 years old. (See Example 3.)

The plan earns 7%.

- Find the balance in the account.

- Suppose that you wait until you are 32 years old to begin making deposits. Find the balance in the account.

- Compare the account balances in part (a) and part (b).

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

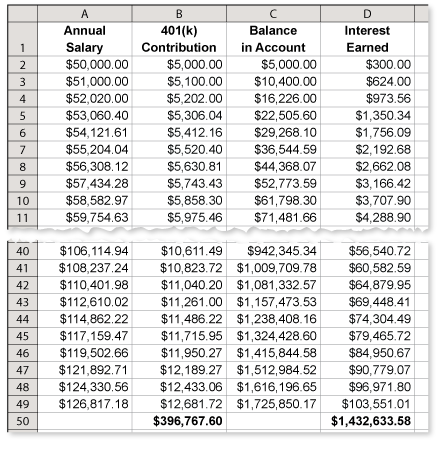

You start your working career when you are 22 years old. Your beginning salary is $50,000 per year. Your employer offers a 401(k) matching retirement plan that amounts to 10% of your salary (5% from you and 5% from your employer). Assume that your salary increases 2% each year and that the 401(k) plan averages 6% annual returns for the life of the plan. (See Example 4.)

- How much have you and your employer contributed to your 401(k) plan when you are 70 years old?

- How much interest has your 401(k) plan earned when you are 70 years old?

- What is the total balance in your 401(k) plan when you are 70 years old?

-

Enter the information into a spreadsheet. (For simplicity, use annual compounding.)

- From the spreadsheet, you can see that you and your employer would have contributed $396,767.60.

- From the spreadsheet, you can see that your account has earned $1,432,633.58 in interest.

- At the end of 48 years, the balance in your account is $1,829,401.18.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You start your working career when you are 22 years old. Your beginning salary is $45,000 per year. Your employer offers a 401(k) matching retirement plan that amounts to 10% of your salary (5% from you and 5% from your employer). Assume that your salary increases 3% each year and that the 401(k) plan averages 8% annual returns for the life of the plan. (See Example 4.)

- How much have you and your employer contributed to your 401(k) plan when you are 67 years old?

- How much interest has your 401(k) plan earned when you are 67 years old?

- What is the total balance in your 401(k) plan when you are 67 years old?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.