-

Lenders may offer you the option to purchase discount points to reduce the interest rate on a loan. One point is equal to one percent of the loan amount.

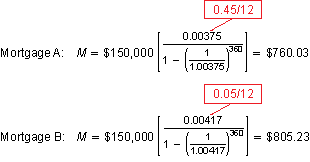

You take out a home mortgage for $150,000 for 30 years.

-

Compare the monthly payments of mortgage A and mortgage B.

Mortgage A: 4.5% with 2 points

Mortgage B: 5% with no points

- Suppose you choose mortgage A. How long will it take you to pay off the points with your monthly savings from the lower rate?

-

a.

With Mortgage B, you are paying

more per month.

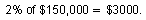

b.The reduction in the rate from 5% to 4.5% cost you 2 points, which is

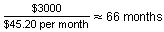

It would take you about

or 5 1/2 years to come to the point where your lower monthly payments would make up for the amount you had to pay for the lower interest rate.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

Lenders may offer you the option to purchase discount points to reduce the interest rate on a loan. One point is equal to one percent of the loan amount.

You take out a home mortgage for $120,000 for 30 years.

-

Compare the monthly payments of mortgage A and mortgage B.

Mortgage A: 5.5% with 3 points

Mortgage B: 6% with 1 point

- Suppose you choose mortgage A. How long will it take you to pay off the points with your monthly savings from the lower rate?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

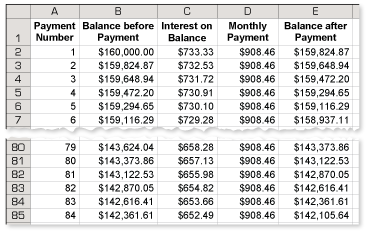

You take out a 7-year balloon mortgage for $160,000. The monthly payment is equal to that of a 30-year mortgage with an annual percentage rate of 5.5%. At the end of 7 years, you have the option to reset the mortgage and pay off the remaining balance over the next 23 years with an annual percentage rate of 6.5%.

- How much interest do you pay?

- How much would you save in interest by taking out a 30-year mortgage with an annual percentage rate of 6%?

-

-

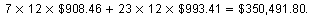

For the first 7 years, your monthly payment would be

By using a spreadsheet, the balance on your mortgage after 7 years is about $142,105.66. To pay this amount at 6.5% for 23 years would result in a monthly payment of

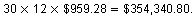

So, the total you paid over 30 years is

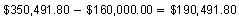

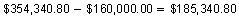

This implies that you paid

in interest.

-

If you had a rate of 6% for 30 years, you monthly payment would be

Over the 30 years, your total payments would be

This implies that you paid

in interest.

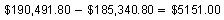

Comparing this to the interest you paid in part (a), you would save

by paying 6% for 30 years instead of using the balloon payment and resetting the mortgage.

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You take out a home mortgage for $150,000 for 15 years with an annual percentage rate of 6%.

- Find the total amount that you pay in interest each year and the total amount that you pay toward the principal each year.

- Make a double bar graph that displays the information in part (a). Describe any trends in the graph.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You can afford to make monthly payments of $600. How large of a home mortgage can you afford at a rate of 5% for a term of 30 years?

-

Using trial and error, you can determine that you can afford a home mortgage of about $112,000.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

You take out a 30-year adjustable-rate mortgage (ARM) for $100,000. The interest rate is 5% for the first 5 years and 8% for the sixth year. What is "ARM reset shock"? How can you avoid it?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.