-

Compare the costs of buying the home and renting a comparable home for $1600 per month. (See Example 5.)

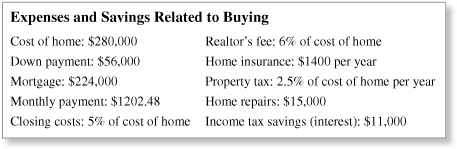

You take out a home mortgage for $224,000 for 30 years at 5%. After 5 years, you move to a different state and sell the home for $294,280. Assume that if you did not buy the home, you could have invested the down payment and earned $12,000 in interest.

-

Buying: Here is a tally of the amounts you spent and saved by buying.

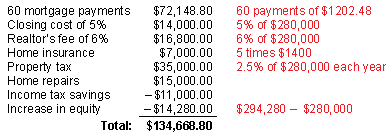

Renting: Here is a tally of what you would have spent by renting.

So, for this particular scenario, it would have cost you a lot less had you rented instead of bought.

The reason for this is that after 5 years, the home was worth only slightly more than what you paid for it.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

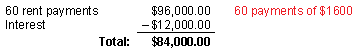

Compare the costs of buying the home and renting a comparable home for $1600 per month. (See Example 5.)

You take out a home mortgage for $200,000 for 30 years at 4%. After 6 years, you move to a different city and sell the home for $281,540. Assume that if you did not buy the home, you could have invested the down payment and earned $13,000 in interest.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

The cost of a home is $162,000. The rent for a comparable home is $800 per month. Find the price-to-rent ratio.

-

The price to rent ratio is

Figuring that a typical price to rent ratio is 15, this ratio is slightly high.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

The cost of the home is $156,000. The rent for a comparable home is $700 per month. Find the price-to-rent ratio.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

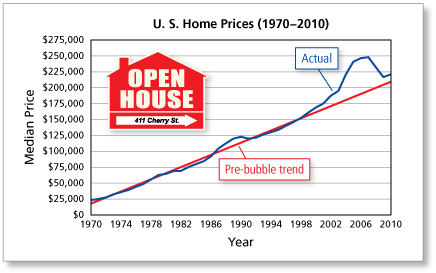

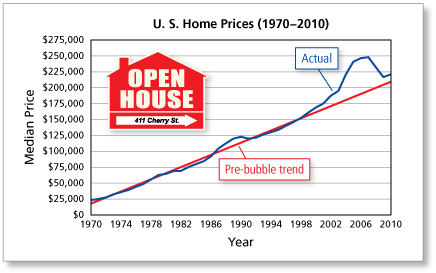

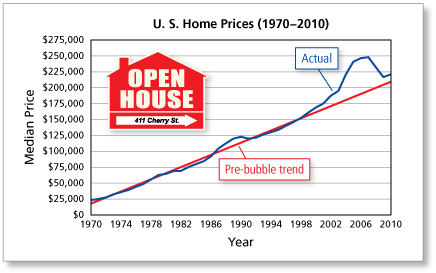

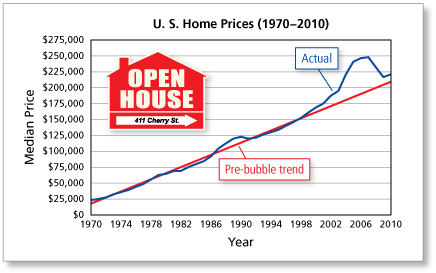

Use the graph on page 279. Suppose home prices followed the pre-bubble trend. (See Example 6.)

- What would have been the price of a home in 2006?

- How much more was the actual price of a home in 2006?

-

- Had housing prices followed the pre-bubble trend, the average cost of a home in 2006 would have been about $190,000.

- With the increase in prices due to the "bubble," the average cost of a home in 2006 was about $245,000. This was an increase of $55,000 more than would have been expected by the linear pattern of growth.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Use the graph on page 279 to estimate the percent change in home prices from 2004 to 2010. (See Example 6.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Use the graph on page 279 to estimate the percent decrease in home prices from 2007 to 2009. (See Example 6.)

-

From 2007 to 2009, the median housing price fell from about $248,000 to about $217,000. This is a percent decrease of about

So, from 2007 the typical value of a house fell by about 13%.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Use the graph on page 279 to compare the percent increase in home prices from 1989 to 1998 to the percent increase in home prices from 1998 to 2007. (See Example 6.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.