-

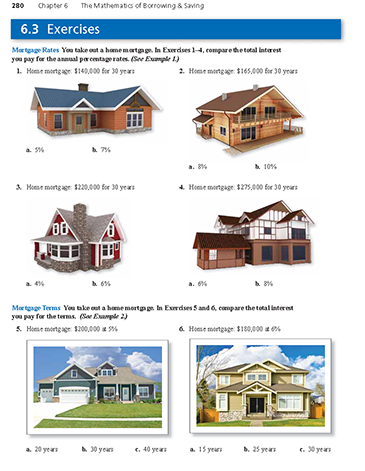

You take out a home mortgage. Compare the total interest you pay for the annual percentage rates. (See Example 1.)

Home mortgage: $140,000 for 30 years

- 5%

- 7%

-

-

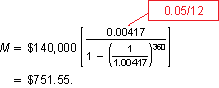

For a principal of $140,000 for 30 years at 5% annual percentage rate, the monthly payment is

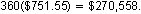

Your payments total

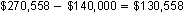

You pay

in interest.

in interest. -

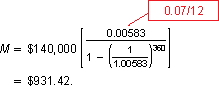

For a principal of $140,000 for 30 years at 7% annual percentage rate, the monthly payment is

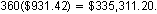

Your payments total

You pay

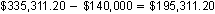

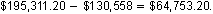

in interest.

in interest.So, an increase of only 2 percentage points increases the interest that you pay by

-

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

You take out a home mortgage. Compare the total interest you pay for the annual percentage rates. (See Example 1.)

Home mortgage: $165,000 for 30 years

- 8%

- 10%

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You take out a home mortgage. Compare the total interest you pay for the annual percentage rates. (See Example 1.)

Home mortgage: $220,000 for 30 years

- 4%

- 6%

-

-

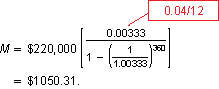

For a principal of $220,000 for 30 years at 4% annual percentage rate, the monthly payment is

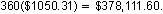

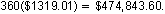

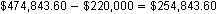

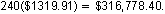

Your payments total

You pay

in interest.

in interest. -

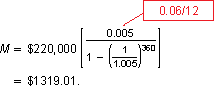

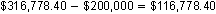

For a principal of $220,000 for 30 years at 6% annual percentage rate, the monthly payment is

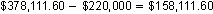

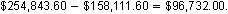

Your payments total

You pay

in interest.

in interest.So, an increase of only 2 percentage points increases the interest that you pay by

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You take out a home mortgage. Compare the total interest you pay for the annual percentage rates. (See Example 1.)

Home mortgage: $275,000 for 30 years

- 6%

- 8%

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You take out a home mortgage. Compare the total interest you pay for the terms. (See Example 2.)

Home mortgage: $200,000 at 5%

- 20 years

- 30 years

- 40 years

-

-

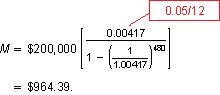

For a principal of $200,000 for 20 years at 5% annual percentage rate, the monthly payment is

Your payments total

You pay

in interest.

in interest. -

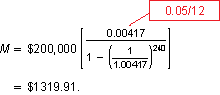

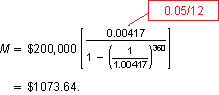

For a principal of $200,000 for 30 years at 5% annual percentage rate, the monthly payment is

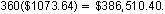

Your payments total

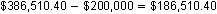

You pay

in interest.

in interest. -

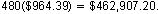

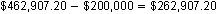

For a principal of $200,000 for 40 years at 5% annual percentage rate, the monthly payment is

Your payments total

You pay

in interest.

in interest.

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You take out a home mortgage. Compare the total interest you pay for the terms. (See Example 2.)

Home mortgage: $180,000 at 6%

- 15 years

- 25 years

- 30 years

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.