-

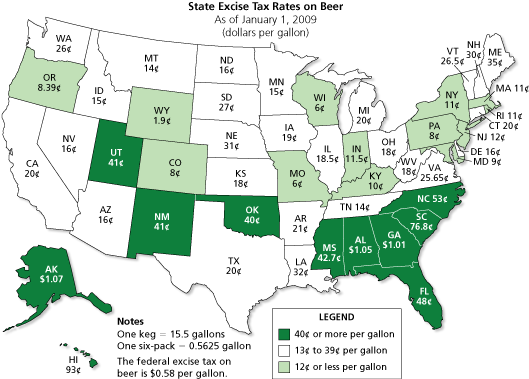

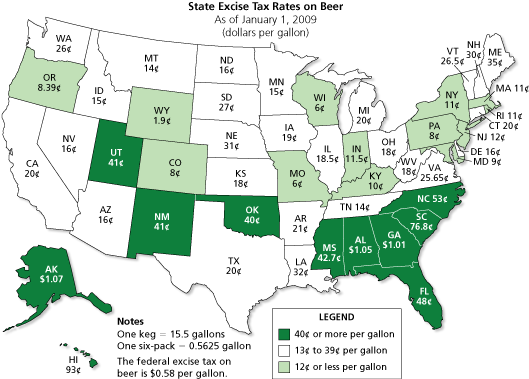

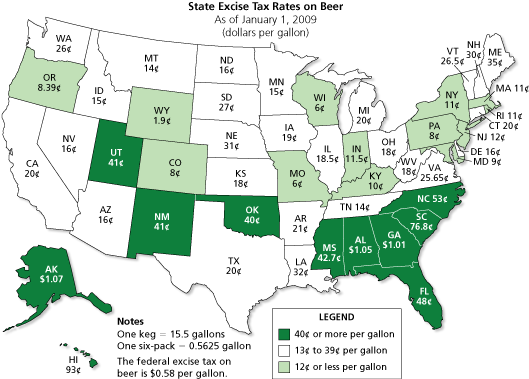

In which state is the excise tax rate on beer the least? the greatest? (See Example 3 and Example 4.)

-

The state with the least excise tax on beer is Wyoming. Its tax is 1.9 cents per gallon.

The state with the greatest excise tax on beer is Alaska. Its tax is $1.07 per gallon.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

A six-pack of beer has a volume of 0.5625 gallon.

The excise tax on beer in Alaska is $1.07 per gallon.

So, the state excise tax on a six-pack of beer in Alaska is $0.60.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

A customer in Florida buys a twelve-pack of beer. How much does the customer pay in federal and state excise taxes? (See Example 3 and Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

A bar manager in South Carolina purchases a keg of beer for $110.00. What percent of the cost is allocated to federal and state excise taxes?(See Example 3 and Example 4.)

-

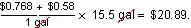

A keg of beer contains 15.5 gallons. The total excise tax on a keg of beer in South Carolina is

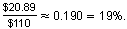

Of the total purchase price of $110, the percent that goes to excise tax is

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

How is an excise tax different from a sales tax? Explain your reasoning.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.