-

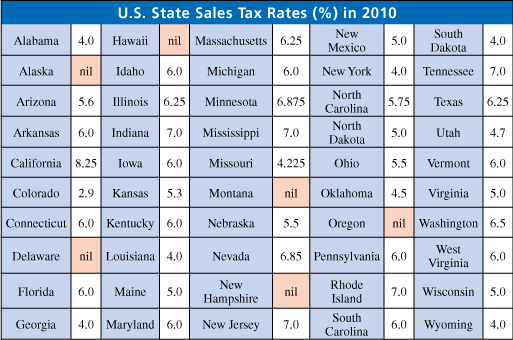

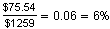

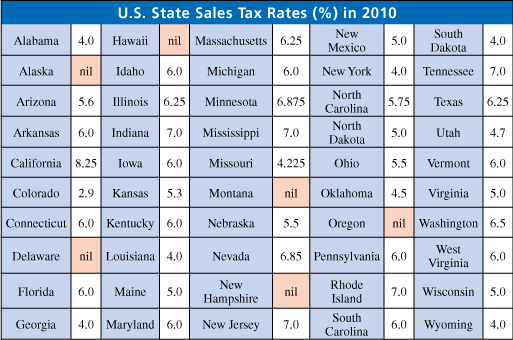

You buy the oil painting in an art gallery in California. What is the state sales tax? (See Example 1 and Example 2.)

-

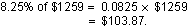

The state sales tax rate in California is 8.25%. This implies that the sales tax is

Note that this is only state sales tax. Some counties and cities in California impose additional sales taxes on items sold within their jurisdiction.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

You buy the oil painting in an art gallery in Missouri. What is the state sales tax? (See Example 1 and Example 2.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

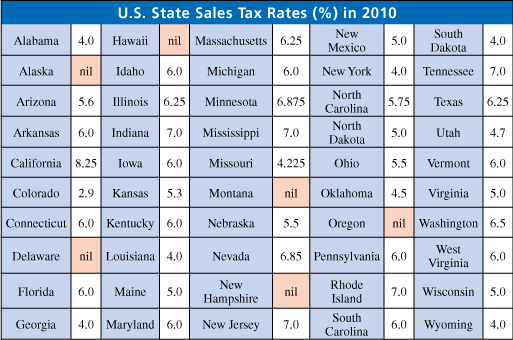

You buy the oil painting in Washington, D.C. The sales receipt shows that you paid $75.54 in sales tax. What is the sales tax rate in Washington, D.C.? (See Example 1 and Example 2.)

-

To find the sales tax rate, divide the sales tax by the purchase price.

The sales tax rate in Washington, D.C. is 6%.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

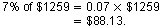

You buy the oil painting in New York. The sales receipt shows that you paid $88.13 in county sales tax. What is the county sales tax rate? (See Example 1 and Example 2.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You can buy the oil painting in Mississippi or drive 20 miles to an art gallery in Alabama to make the purchase. Which option would you choose? Explain your reasoning. (See Example 1 and Example 2.)

-

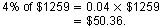

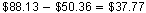

The sales tax in Mississippi is

The sales tax in Alabama is

A person can save

in sales tax by purchasing the painting in Alabama.

in sales tax by purchasing the painting in Alabama.Note that sales tax laws vary from state to state. In some states, residents owe sales tax to the state regardless of where the item is purchased.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Under what conditions is it beneficial to a consumer to drive to another state to make a purchase? Give specific examples.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You are given the sales receipt shown after buying a T-shirt. Find the sales tax rates indicated by the receipt. (See Example 2.)

-

The sales tax rates are

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Some people avoid paying sales tax by purchasing items out of state. This is a big problem for many states. What would you do as a state legislator to fix the problem?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.