-

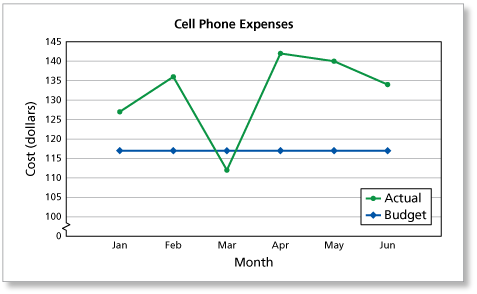

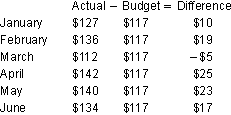

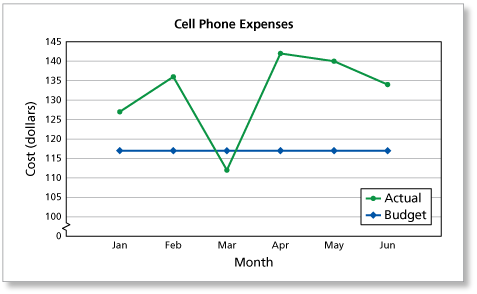

Estimate the difference between the actual amount and the budgeted amount for each month.

-

Begin by estimating the budgeted and actual monthly expenses. Then subtract the budgeted expense from the actual expense for each month.

Your worst month was April when your expenses were $25 over budget.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

What effect does exceeding the budgeted cell phone expense have on the budget surplus or shortage? Explain.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

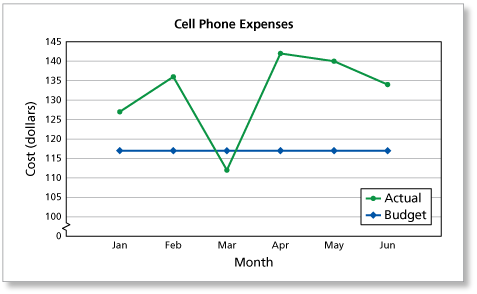

Based on the line graph, what adjustments should you make to your monthly budget?

-

Your actual cell phone expenses are consistently coming in above your budget. You have four basic options for correcting this.

- Increase your budgeted amount to about $135 a month.

- Lower the amount you use your cell phone.

- Talk to your cell phone provider about switching to a cheaper plan.

- Switch providers to a company that has a cheaper plan.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

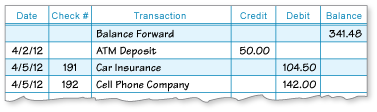

You pay April's cell phone bill with check #192. Your checkbook registry is shown. What is the balance in your checking account as of 4/5/12?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

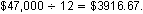

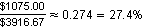

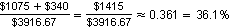

You are interested in buying a house. Your realtor determines that the monthly mortgage payment (including property taxes and insurance) would be $1075.00. Your gross annual income is $47,000 and you already have a monthly car payment and a monthly credit card payment totaling $340. According to the 28/36 rules, should you qualify for the home mortgage?

-

The 28% Rule states that the ratio of your monthly mortgage (including loan payment, property taxes, and insurance) to your gross monthly income should not exceed 28%. Your gross monthly income is

The 36% Rule states that the ratio of your total monthly debt payments (mortgage, credit card minimum payments, loans, and all other debts) to your gross monthly income should not exceed 36%.

You are only one-tenth of a percent over for the 36% Rule. Most banks would probably determine that you qualify for the home mortgage.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Use the Internet to research the 28/36 rules. How were the qualifying levels for a home mortgage determined to be 28% and 36%?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.