-

When you make broad estimates like the one in Example 3, remember that your estimate is only as good as your assumptions. It is a good idea to explicitly write your assumptions down and then to list them whenever you communicate your estimate.

For instance, one of the assumptions is that roughly 20% of adults in the United States smoke cigarettes. If the true percent is closer to 15%, then your final estimate will be roughly one third greater than it should have been.

-

Forty-six states and Washington, DC have increased cigarette tax rates 101 times since 2002. The average state excise tax on a pack of cigarettes is currently $1.34.

If you're looking for more information on excise taxes, The Tax Foundation lists cigarette, gasoline, and alcohol tax rates by state.

-

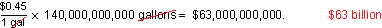

The United States uses about 140 billion gallons of gasoline in a year. Federal excise tax is about $0.18 per gallon and state excise taxes range from $0.08 to $0.45. Let's estimate the average to be $0.45 per gallon (including state and federal).

This means that the total excise tax revenue on gasoline is about

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.

http://www.andyou.com/blog/math-in-the-news/math-in-the-news-excise-taxes/