-

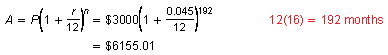

Suppose that you deposit $3000 into a savings account that earns 4.5%, compounded monthly.

Find the balance in the account after each time period.

a. 16 years

b. 32 years

-

Using the formula for compound interest, the balances are as follows.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

Suppose that you deposit $3000 into a savings account that earns 4.5%, compounded monthly. Your friend deposits $2500 into a savings account that earns 6.5%, compounded monthly. Which account has the greater balance after 10 years?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

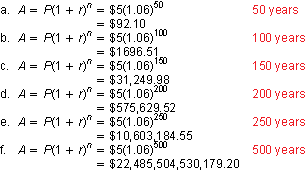

You start your working career when you are 22 years old. Each month, you deposit $200 into a retirement plan that earns 8%, compounded monthly. You continue making deposits into the plan until you are 67 years old.

Find the balance in the account.

-

Use the formula for the balance in an increasing annuity.

The reason that the balance is so great is that 8% is a huge annual percentage rate to earn on an investment. Historically, however, this type of rate has been possible with stock investments. Stock investments, of course, are not guaranteed.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

You start your working career when you are 22 years old. Each month, you deposit $200 into a retirement plan that earns 8%, compounded monthly. You continue making deposits into the plan until you are 67 years old.

You want an income of $100,000 a year.

- How much have you withdrawn in total from your account after 10 years?

- How much interest has the account earned after 10 years?

- After 10 years, what is the balance in your account?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

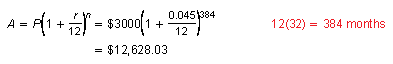

You deposit $5 into a savings account that earns 6%, compounded annually. You stipulate that the balance will be divided evenly among your living heirs in 500 years. Find the balance in the account after each time period.

a. 50 years

c. 150 years

e. 250 years

b. 100 years

d. 200 years

f. 500 years

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

You are 55 years old and you have worked for a government municipality for 30 years. Your defined benefit retirement plan will pay you 2% of the average income for the last 3 years for each year you have worked. Your average annual income during the past 3 years is $60,000. This will increase by 3.5% each year. Suppose you live to age 85. At what age should you retire to receive the greatest retirement income?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.