-

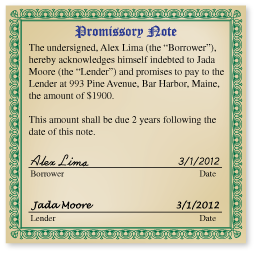

Find (a) the term of the loan and (b) the total amount due. (See Example 1.)

-

- The term of the loan is 2 years.

- The total amount due is $1900.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

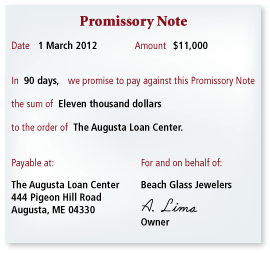

Find (a) the term of the loan and (b) the total amount due. (See Example 1.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

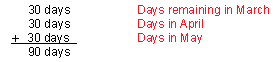

The note was signed on March 1, 2012. It is due in 90 days.

So, the note is due on May 30, 2012.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

On April 19, you obtain a 60-day note for $5000. The costs include $81.37 for interest and a $50.99 service charge. When is the note due? How much is due at the end of 60 days? (See Example 2.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

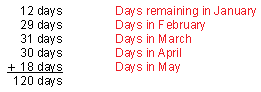

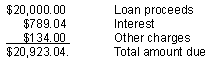

You obtain a 120-day note for $20,000 to use as a down payment on a home. The loan takes place on January 19. The costs include $789.04 for interest and $134 in other charges. When is the note due? How much is due at the end of 120 days? (See Example 2.)

-

The note was signed on January 19, 2012. It is due in 120 days.

So, the note is due on May 18, 2012.

At that time the total amount due is

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

On January 19, 2013, you obtain a 120-day note. Is the due date on the same day of the year as in Exercise 5? Explain. (See Example 2.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.