-

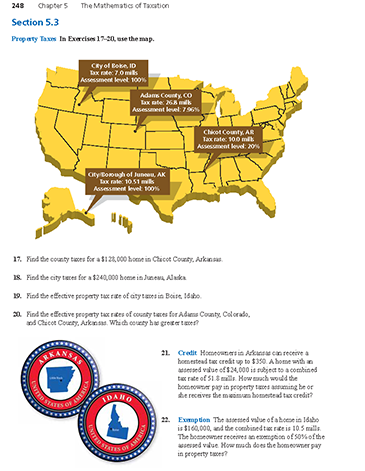

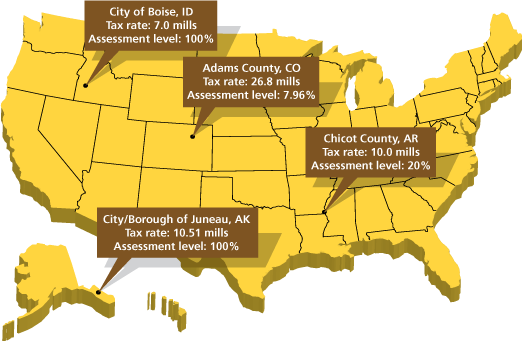

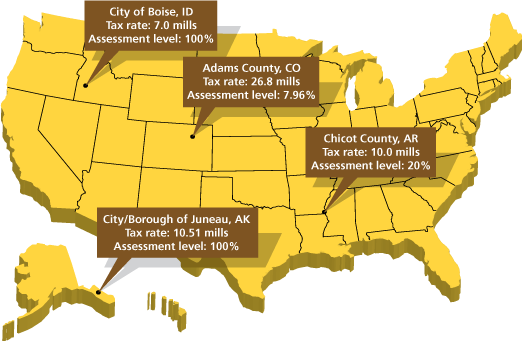

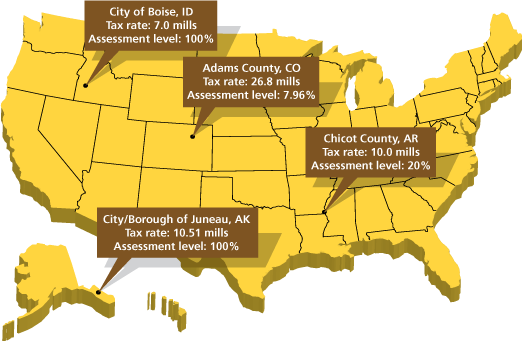

Using the information on the map, find the county taxes for a $128,000 home in Chicot County, Arkansas.

-

The property tax on a home in Chicot County, Arkansas, assessed at $128,000 is

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

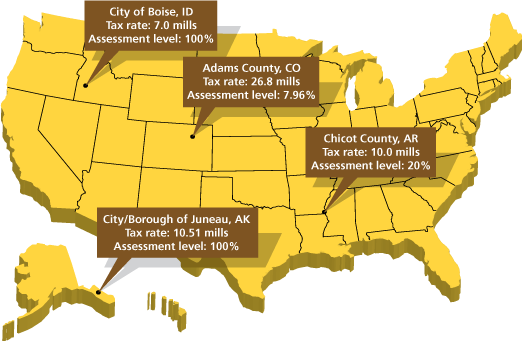

Using the information on the map, find the city taxes for a $240,000 home in Juneau, Alaska.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Using the information on the map, find the effective property tax rate of city taxes in Boise, Idaho.

-

The assessment level in Boise, Idaho, is 100%. So, the effective tax rate is

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Find the effective property tax rates of county taxes for Adams County, Colorado, and Chicot County, Arkansas. Which county has greater taxes?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

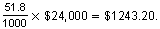

Homeowners in Arkansas can receive a homestead tax credit up to $350. A home with an assessed value of $24,000 is subject to a combined tax rate of 51.8 mills. How much would the homeowner pay in property taxes assuming he or she receives the maximum homestead tax credit?

-

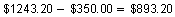

Without the homestead tax credit, the property tax would be

Because the maximum homestead tax credit is $350, the homeowner would have to pay

in property taxes.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

The assessed value of a home in Idaho is $160,000, and the combined tax rate is 10.5 mills. The homeowner receives an exemption of 50% of the assessed value. How much does the homeowner pay in property taxes?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.