-

Massachusetts has a flat income tax with a rate of 5.3%. Determine how much state income tax the person owes.

A person who lives in Massachusetts has a taxable income of $45,000.

-

The income tax for the person is

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

Massachusetts has a flat income tax with a rate of 5.3%. Determine how much state income tax the person owes.

A person who lives in Massachusetts has a taxable income of $1,000,000.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

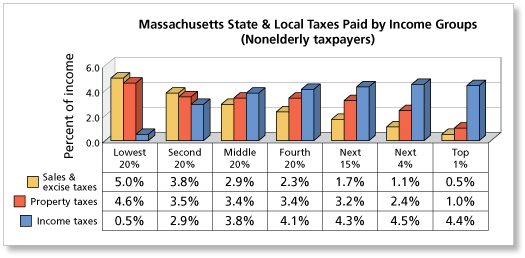

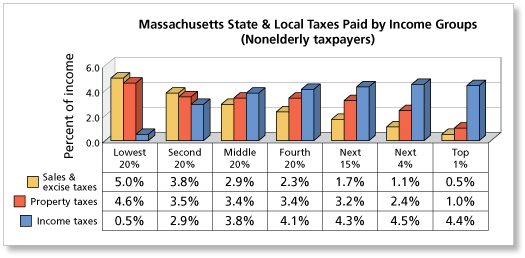

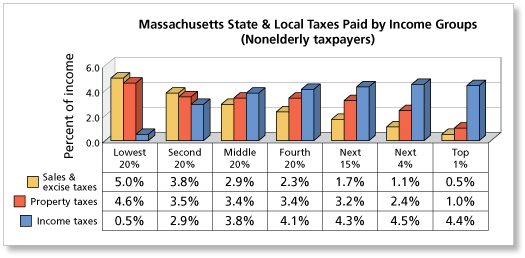

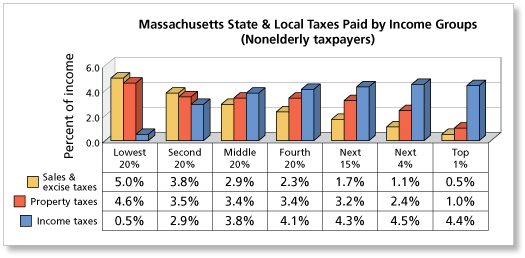

The income for a family in the middle 20% is $53,000. How much, in dollars, does this family pay for each type of tax?

-

Sales & excise taxes:

Property taxes:

Income taxes:

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

The income for a family in the top 1% is $2,600,000. How much, in dollars, does this family pay for each type of tax?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Determine whether the three types of taxes are regressive, flat, or progressive in Massachusetts.

-

- Sales & excise taxes are regressive because people in higher income brackets pay a lower rate.

- Property taxes are also regressive because people in higher income brackets pay a lower rate.

- Income taxes are progressive because people in higher income brackets pay a higher rate. Although Massachusetts has a flat tax rate of 5.3% (see Exercise 1), the deductions allowed by the state end up making the income tax progressive.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Are taxes, as a whole, regressive, flat, or progressive in Massachusetts? Explain your reasoning.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Massachusetts had a 6.25% sales tax on alcohol from August 2009 to December 2010. Part of the revenue from the tax was used to fund substance abuse programs. This tax was abolished in December, 2010. Do you agree with such a tax? Why or why not.

-

This was a controversial tax. Although it was successful in raising money for the state, it was unpopular and was easily defeated when it came up for abolishment on a state-wide ballot.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Suppose the revenue from a sales tax on cigarettes is used to offset the costs of a new health insurance law. Discuss ways in which the tax might help the people who are paying the tax.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.