-

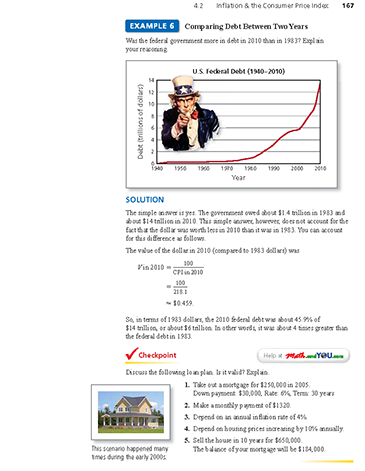

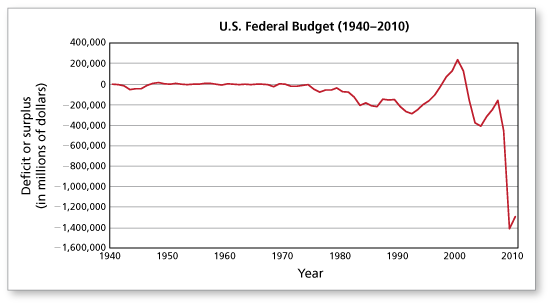

A budget deficit occurs when spending exceeds revenue, and a surplus occurs when revenue exceeds spending. The U.S. federal government deficits (or surpluses) are shown in the graph below. (A value less than $0 represents a deficit, and a value greater than $0 is a surplus.). Since 1980, the government has had a surplus in only four fiscal years. Compare the graph to the one of the U.S. Federal Debt in Example 6 on page 167. What do you notice?

Note on the Fiscal Year

The Federal fiscal year begins on October 1 and ends on the subsequent September 30. It is designated by the year in which it ends; for example, fiscal year 2010 began on October 1, 2009, and ended on September 30, 2010. Prior to fiscal year 1977 the Federal fiscal years began on July 1 and ended on June 30. In calendar year 1976 the July-September period was a separate accounting period (known as the transition quarter or TQ) to bridge the period required to shift to the new fiscal year. In the figure above, the receipts and outlays incurred during TQ were split evenly and added to those of 1976 and 1977. (Source: Office of Management and Budget)

-

Interested in finding out how much your home is worth? Websites like zillow.com can give you an estimate based on nearby property value appraisals. You can also talk to a real estate agent to get a more accurate estimate of the value of your home, taking additional factors into consideration, such as property renovations. Visit the National Association of Realtors to find an agent near you.

-

This loan plan is not valid because it is not realistic to assume housing prices will increase by 10% annually. Housing prices often increase by less than 10% from year to year and have even decreased in recent years. It is also not realistic to assume a constant 4% annual inflation rate.

-

Comments (1)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 1 commentsSubscribe by email Subscribe by RSSGuest 1 decade ago |This is my greatest worry. I can't understand why the people in Washington continue to put the United States into more and more debt.0 0