-

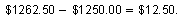

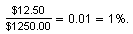

You open a savings account and deposit $1250.00. One year later, the balance in the account is $1262.50. No other transactions were posted to the account. What is the annual rate of growth for the savings account? (See Example 5 and Example 6.)

-

The interest earned during the year is

So, the annual interest rate is

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

You open a savings account and deposit $4200.00. One month later, the balance in the account is $4208.40. No other transactions were posted to the account. What is the monthly rate of growth for the savings account? (See Example 5 and Example 6.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 2 commentsGuest 2 years ago |bruh1 0Guest 3 years ago |what is the worked out solution for this one2 0 -

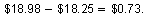

You buy 50 shares of stock for $18.25 per share. One month later, the value of the stock is $18.98 per share. (See Example 5 and Example 6)

- The value of the stock continues to increase by the same dollar amount each month. How much will your investment be worth in 1 year?

- The value of the stock continues to increase by the same percent each month. How much will your investment be worth in 1 year?

-

-

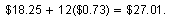

The increase in value during the month is

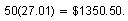

If it increases by the same amount each month, then the value at the end of one year will be

So, your investment will be worth

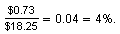

- The percent increase for the first month is

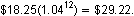

If it increases by the same amount each month, then the value at the end of one year will be

So, your investment will be worth

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You buy 65 shares of stock for $12.00 per share. One month later, the value of the stock is $12.78 per share. (See Example 5 and Example 6.)

- The value of the stock continues to increase by the same dollar amount each month. How much will your investment be worth in 3 years?

- The value of the stock continues to increase by the same percent each month. How much will your investment be worth in 3 years?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

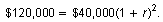

During the first year of operation, a company makes a profit of $40,000. During the third year of operation, the company makes a profit of $120,000. Estimate its annual rate of growth. (See Example 5 and Example 6.)

-

To estimate the annual rate of growth, you need to find a value of r such that

After some trial and error, you can see that the value of r is about 0.732. This means that the annual rate of growth was about 73.2%.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

You buy a coin collection for $10,000. Two years later, you sell the coin collection for $12,500. Estimate its annual rate of growth. (See Example 5 and Example 6.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

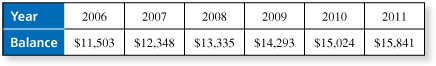

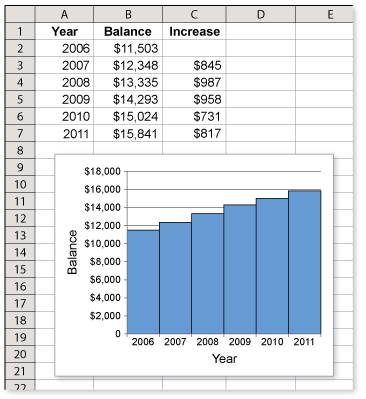

Mathematical models rarely match real-life data perfectly. In general, a model will give an approximate value for each input. The table shows the balances of an investment account at the end of six continuous years. Would the data in the table be better represented by a linear growth model or an exponential growth model? Explain your reasoning. (See Example 5 and Example 6)

-

To decide whether the data is better modeled by a linear growth model or an exponential growth model, enter the data into a spreadsheet and sketch its graph.

The balance appears to be increasing by about the same amount each year. So, the data is better modeled by a linear growth model.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Investing in the stock market can be nerve racking due to the uncertainty of how a stock will perform. A risk-averse investor might put money in bonds or a savings account with a low but guaranteed interest rate. How would you invest a $10,000 windfall? Explain your reasoning.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.