-

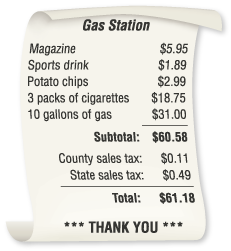

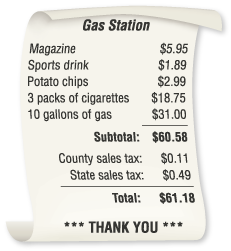

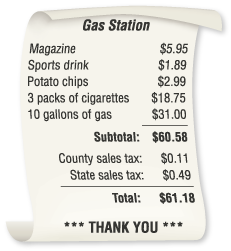

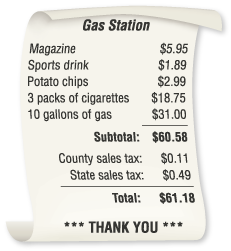

Use the sales receipt. Sales taxes are not applied to cigarettes and gasoline for this purchase.

- What is the state sales tax rate?

- What is the county sales tax rate?

- Use the table on page 80 to determine the state in which the gas station is located.

-

-

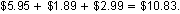

The total of the taxable items is

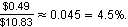

The state sales tax rate is

-

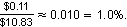

The county sales tax rate is

-

In 2010, there was only one state that had a state sales tax of 4.5%. That was Oklahoma. The county and city tax rates in Oklahoma vary greatly.

-

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

The state excise tax on a pack of cigarettes is $1.03.

- How much is paid in state excise tax for the cigarettes?

- What percent of the cost of the cigarettes is allocated to state excise tax?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

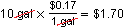

The state excise tax on a gallon of gasoline is $0.17.

- How much is paid in state excise tax for the gasoline?

- What percent of the cost of the gasoline is allocated to state excise tax?

-

-

The state excise tax is $0.17 per gallon. So, the charge of $31.00 includes

as state excise tax on gasoline.

-

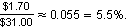

The excise tax of $1.70 was based on a charge of $31.00. So, the state excise tax rate on gasoline is

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

How would you enter this trip to the gas station in your monthly budget?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

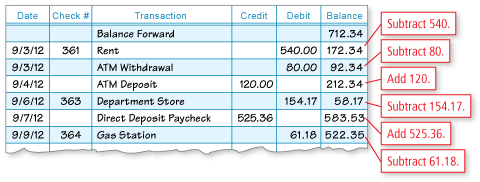

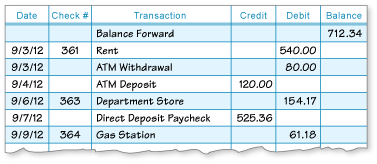

When balancing your checkbook, remember to subtract debits (expenses) and add credits (deposits).

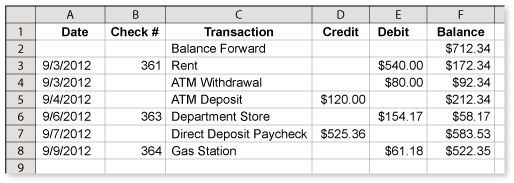

Because it is so easy to make calculation errors, it is good to use a spreadsheet to check your calculations.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

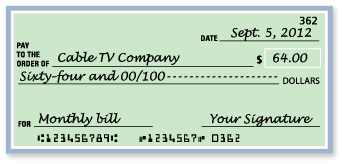

You forget to record check #362 in your checkbook registry.

- Explain the consequences of this omission.

- Your bank charges $40 for a bad check. Find the actual balance in your checking account as of 9/9/12.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.