-

Monthly budgets should include expenses that occur quarterly, semiannually, or annually. When you divide these expenses to find a monthly average, you are prorating the expense. A gym membership is $150 each quarter. Prorate this expense for your monthly budget.

-

You should plan on a monthly expense of $50. To make your budget run smoothly, you need to set aside $50 months before your quarterly gym membership is due.

Month

January

February

March

April

May

June

July

August

September

October

November

December

Budget

Set aside $50.

Set aside $50.

Pay gym membership of $150.

Set aside $50.

Set aside $50.

Pay gym membership of $150.

Set aside $50.

Set aside $50.

Pay gym membership of $150.

Set aside $50.

Set aside $50.

Pay gym membership of $150.

This concept seems simple enough. And yet, it is surprising how many people are caught off guard with expenses that occur quarterly, semiannually, or annually. Here are some other examples.

- Holiday expenses

- Property taxes

- Quarterly income tax payments for self employment

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

For some months, the actual amount spent on prorated expenses will be $0. As a result, the surplus in your monthly budget should increase by the budgeted amount for the expense. Why should you transfer this surplus to savings?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You are planning to buy a new house, which will increase your shelter expenses by $400. What adjustments would you make to your budget to accommodate the increased expense?

-

In broad terms, you really have only two options.

- Cut $400 from other monthly budgeted items.

- Increase your monthly income by $400 or more.

If you choose the first option, be sure you consider the consequences of cutting from your budgeted amounts for retirement and for savings. There are many websites that offer suggestions for economizing expenses on a reduced budget. Here is one simple suggestion.

"Rid yourself of the myth that "bargain brands" are less desirable than more expensive choices. Read labels at your usual store without buying, then go to a discount store and check out labels again. You'll find items containing the same ingredients for lower prices." (Source: eHow)

There are dozens of other suggestions for cutting back on monthly expenses.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Many people make sincere attempts to follow a monthly budget. However, for some people, these attempts fail because they either spend more than they should on a certain category or they underestimate an expense in the budget. How can you handle an expense that seems to repeatedly go over budget?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

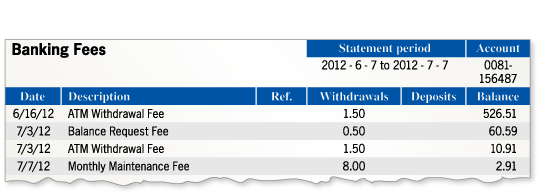

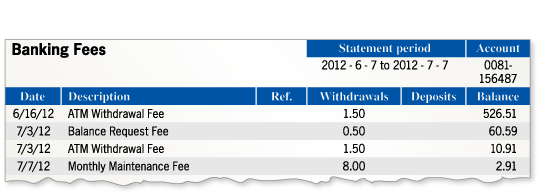

Many banks and credit unions charge their customers some type of monthly maintenance fee, or various transaction fees such as an ATM withdrawal fee. Why should you account for the bank fees in your checkbook registry?

-

From the portion of the bank statement, it is clear why you should account for the bank fees in your checkbook registry. In the month shown, you paid a total of $11.50 in fees. These were deducted on the days that each occurred.

Your balance on 7/7/12 was only $2.91. If you had not entered the fees into your checkbook registry, then you would think your balance was $11.50 + $2.91 = $14.41. Writing a check for any amount over $2.91 would result in an overdraft and a potentially high overdraft fee.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Many banks and credit unions charge their customers some type of monthly maintenance fee, or various transaction fees such as an ATM withdrawal fee. As an executive at a bank, you are in charge of setting up the fee structure, including monthly maintenance fees, bad check fees, and ATM transaction fees. Write a detailed policy explaining how and when these fees would be applied to a customer's account.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.