-

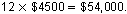

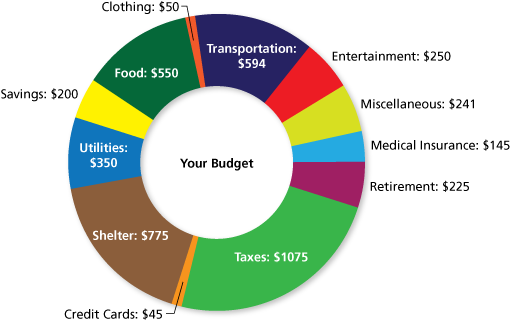

Your entire monthly income is represented in the doughnut graph. Find your gross annual income. (See Example 5 and Example 6.)

-

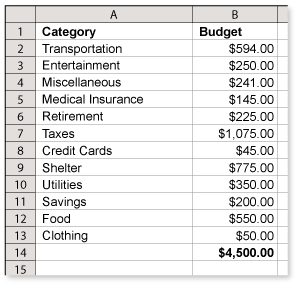

An easy way to find your total monthly income is to enter each category in a spreadsheet and then total the column.

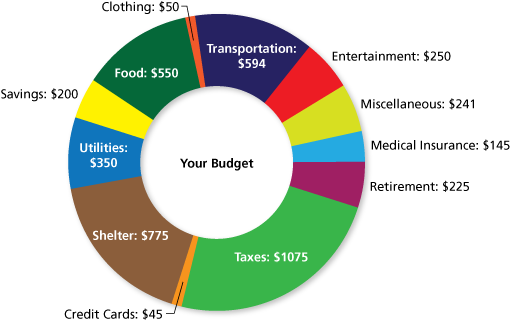

With a total monthly income of $4500, your total annual income is

As it happens, this annual income is close to the median annual income for a household in the United States.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Graphical Estimation: In the doughnut graph, you know that a quarter of the doughnut represents 25% of the monthly total. The red part (entertainment) is roughly one-fifth of a quarter of the graph. So, you can estimate that entertainment represents about 5% of your monthly budget.

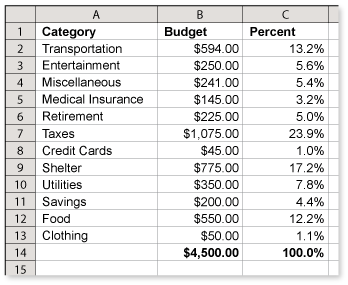

Calculation: To calculate the percent for any category, you can use the spreadsheet that you created in Exercise 15. In the column for percent, divide each budgeted amount by $4500 (your total monthly income).

So, you are budgeting about 6% of your monthly income for entertainment. This agrees with the graphical estimation of 5%.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

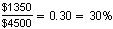

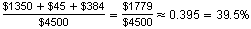

You are interested in buying a house. Your realtor determines that the monthly mortgage (including property taxes and insurance) for the house is $1350.00. Of the $594 budgeted for transportation expenses, $384 is your car payment. According to the 28/36 rules, do you qualify for the home mortgage? (See Example 5 and Example 6.)

-

The 28% Rule states that the ratio of your monthly mortgage (including loan payment, property taxes, and insurance) to your gross monthly income should not exceed 28%.

The 36% Rule states that the ratio of your total monthly debt payments (mortgage, credit card minimum payments, loans, and all other debts) to your gross monthly income should not exceed 36%.

So, using the 28/36 rules, you fail to qualify for the home mortgage.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Using the 28/36 rules, how much do you think you will be able to spend on a monthly mortgage payment 10 years from now? Explain your reasoning. (See Example 5 and Example 6.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

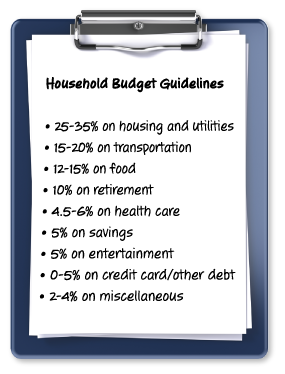

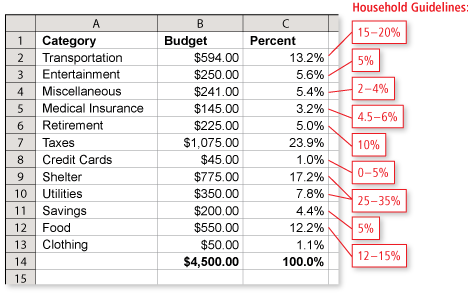

You go to a financial adviser to get advice about household budgets. The financial adviser gives you the general percent guidelines shown. How does your budget compare with the guidelines? (See Example 5 and Example 6.)

-

According to the Household Budget Guidelines, your budget is looking good. You are keeping your expenses under the guideline percents.

Here are your areas of concern.

- You only set aside 5% for retirement. This is half the recommended amount.

- If you combine 1.1% for clothing with 5.4% for miscellaneous, you get a total of 6.5%. Comparing this to the miscellaneous recommendation of 2-4%, your budget is about double the recommended amount.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.