-

Example 2 is a correct use of the word "markup." Notice that the transaction involves only buying the handbag and reselling it. Remember that the term "markup" should not be used when a business adds something to the product. That process is called "value added." For instance, when a custom van company buys the shell of a new van for $5000, adds a luxury interior, and resells the van for $25,000, the increase in price is not called "markup."

In Example 2, there are two important points for people who run small business ventures such as this one.

- Be sure to keep a record of all of your expenses. In this example, notice how incorrect it would be to tell someone that you bought the handbag for $195 and sold it for a profit of $200. It sounds really nice, but it simply doesn't take into account all of your expenses.

- Anytime you earn money, whether it is babysitting, tips, mowing lawns, or having a yard sale, you are responsible for claiming the income on your state and federal income tax returns. Failure to do this is a punishable crime. No one knows the extent of the lost tax revenue from unreported income, but the U.S. Treasury Department has estimated that the problem costs the government about $250 billion per year.

-

Did you know that eBay was started by Pierre Omidyar as a side hobby while he worked his day job? Today eBay is estimated to be valued at $10 billion. Use a search engine to search for the phrase "turning your hobby into a career" to get some tips about how to make money off of your hobby.

If you want to know more facts about eBay, read the article 99 Interesting Facts About eBay

-

This is a common error in business. The problem is that the business is using the wrong denominator.

Correct Denominator:

Incorrect Denominator:

So, the bookstore is actually using a markup of about 42.9%, not 30%. Although this could be an innocent error, because the error results in claiming a smaller markup percent, one is tempted to suspect that the error is sometimes intentional.

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.

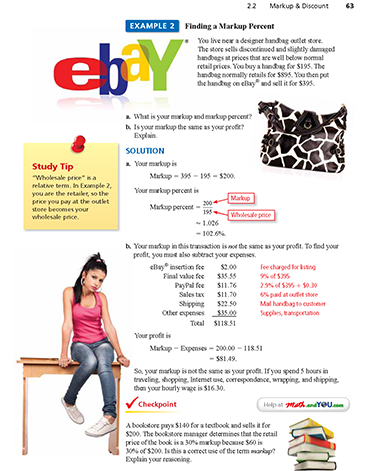

Your profit equals your Markup minus your Expenses.

In the given case, the markup was $200.00, and expenses were $118.51, giving you a profit of $81.49.

The listing of eBay expenses can be found in part B of the solution.

Please let us know if you have any additional questions. Thanks!