-

You take out a home mortgage for $170,000 for 30 years at 5%. The regular monthly payment is $912.60.

Compare the total interest you pay to the total interest of a home mortgage for $170,000 for 30 years at 7%.

-

At 7%, the monthly payment is

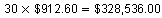

At 5%: The total of the 360 payments is

At 7%: The total of the 360 payments is

So, with the higher interest rate, you would pay

more in interest.

Comments (1)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 1 commentsSubscribe by email Subscribe by RSSGuest 6 years ago |f1 0 -

-

You take out a home mortgage for $170,000 for 30 years at 5%. The regular monthly payment is $912.60.

Compare the total interest you pay to the total interest of a home mortgage for $170,000 for 15 years at 5%.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

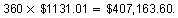

You take out a home mortgage for $170,000 for 30 years at 5%. The regular monthly payment is $912.60.

Each month, you make the regular payment of $912.60 plus an additional $50.

- How much sooner do you pay off the mortgage?

- How much do you save in interest?

-

Use a spreadsheet.

- You paid the loan off 360 - 321 = 39 months (or about 3 years) sooner.

-

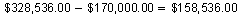

Had you paid the regular payments of $912.60 for 30 years, you would have paid

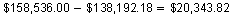

in total payments. This means that you paid

in interest. So, by making an additional payment of $50 each month, you saved

in interest.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You take out a home mortgage for $170,000 for 30 years at 5%. The regular monthly payment is $912.60.

The monthly payment for a 5-year balloon mortgage for $170,000 is equal to that of a 30-year mortgage with an annual percentage rate of 5%. Find the balloon payment and the total interest that you pay.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You take out a home mortgage for $170,000 for 30 years at 5%. The regular monthly payment is $912.60.

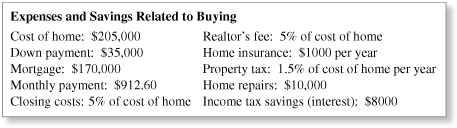

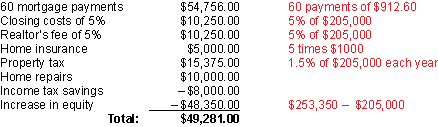

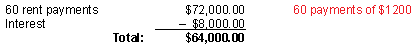

After 5 years, you move to a different state and sell the house for $253,350. Compare the costs of buying the home and renting a comparable home for $1200 per month. Assume that if you did not buy the home, you could have invested the down payment and earned $8000 in interest.

-

Buying: Here is a tally of the amounts you spent and saved by buying.

Renting: Here is a tally of what you would have spent by renting.

So, for this particular scenario, it cost you less to buy than to rent.

The reason for this is that you were able to sell your house for substantially more than you paid for it.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Describe what happens to the prices of homes during a bubble. What happens when the bubble bursts?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.