-

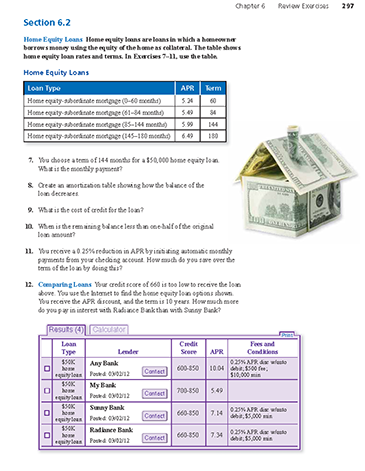

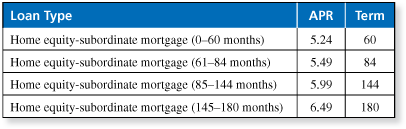

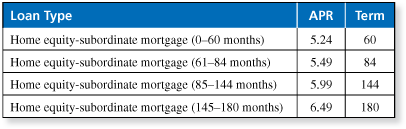

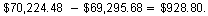

Home equity loans are loans in which a homeowner borrows money using the equity of the home as collateral. The table shows home equity loan rates and terms.

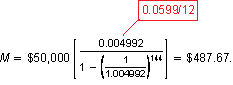

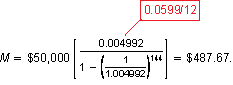

You choose a term of 144 months for a $50,000 home equity loan. What is the monthly payment?

-

For a 144-month loan, the annual percentage rate is 5.99%. This implies that the monthly payment is

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

Home equity loans are loans in which a homeowner borrows money using the equity of the home as collateral. The table shows home equity loan rates and terms.

You choose a term of 144 months for a $50,000 home equity loan. Create an amortization table showing how the balance of the loan decreases.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Home equity loans are loans in which a homeowner borrows money using the equity of the home as collateral. The table shows home equity loan rates and terms.

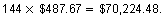

You choose a term of 144 months for a $50,000 home equity loan. What is the cost of credit for the loan?

-

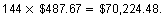

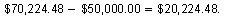

For a 144-month loan, the annual percentage rate is 5.99%. This implies that the monthly payment is

The total of the 114 payments is

So, the cost of credit is

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Home equity loans are loans in which a homeowner borrows money using the equity of the home as collateral. The table shows home equity loan rates and terms.

You choose a term of 144 months for a $50,000 home equity loan. When is the remaining balance less than one-half of the original loan amount?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Home equity loans are loans in which a homeowner borrows money using the equity of the home as collateral. The table shows home equity loan rates and terms.

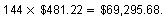

You choose a term of 144 months for a $50,000 home equity loan. You receive a 0.25% reduction in APR by initiating automatic monthly payments from your checking account. How much do you save over the term of the loan by doing this?

-

For a 144-month loan, the annual percentage rate is 5.99%. This implies that the monthly payment is

The total of the 144 payments is

With a 0.25% reduction in the annual percentage rate, the monthly payment is

The total of the 144 payments is

So, by taking the automatic payment option, you save

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

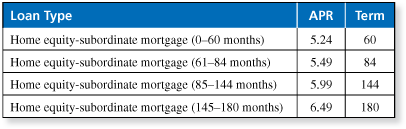

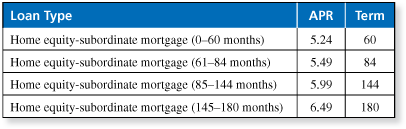

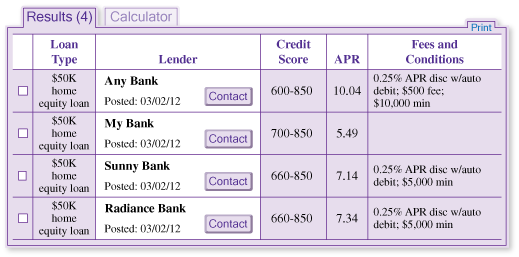

Home equity loans are loans in which a homeowner borrows money using the equity of the home as collateral. The table shows home equity loan rates and terms.

You choose a term of 144 months for a $50,000 home equity loan. Your credit score of 660 is too low to receive the loan. You use the Internet to find the home equity loan options shown. You receive the APR discount, and the term is 10 years. How much more do you pay in interest with Radiance Bank than with Sunny Bank?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.