-

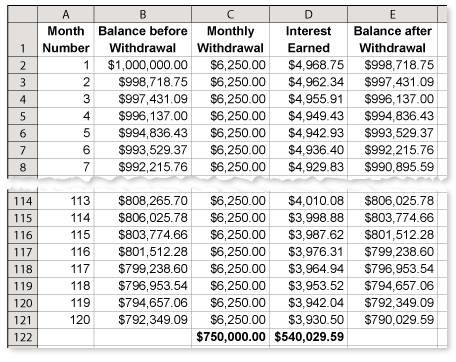

You retire at age 67. Your 401(k) retirement plan has a balance of $1 million and compounds interest monthly. (See Example 5.)

The account earns 6%, and you want an income of $75,000 a year.

- How much have you withdrawn in total from your account after 10 years?

- How much interest has the account earned after 10 years?

- After 10 years, what is the balance in your account?

-

Enter the information into a spreadsheet.

- From the spreadsheet, you can see that you withdrew $750,000 during the 10 years.

- From the spreadsheet, you can see that your account has earned $540,029.59 in interest during the 10 years.

- From the spreadsheet, you can see that the balance in your account is $790,029.59.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

You retire at age 67. Your 401(k) retirement plan has a balance of $1 million and compounds interest monthly. (See Example 5.)

The account earns 8%, and you want an income of $90,000 a year.

- How much have you withdrawn in total from your account after 20 years?

- How much interest has the account earned after 20 years?

- After 20 years, what is the balance in your account?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

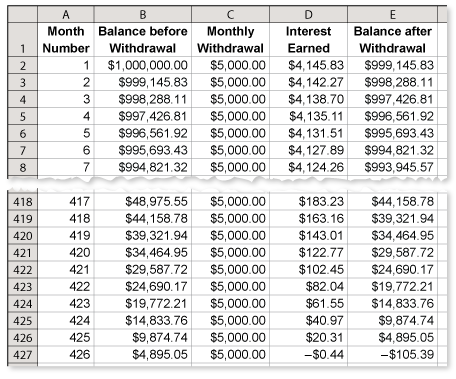

You retire at age 67. Your 401(k) retirement plan has a balance of $1 million and compounds interest monthly. (See Example 5.)

The account earns 5%. How many years can the account support withdrawals of $60,000 a year?

-

This question is best answered with a spreadsheet. By entering the information into a spreadsheet, you can see that you can continue to withdraw $60,000 a year from the account for 426 months or 35.5 years.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

You retire at age 67. Your 401(k) retirement plan has a balance of $1 million and compounds interest monthly. (See Example 5.)

The account earns 5%. How many years can the account support withdrawals of $85,000 a year?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

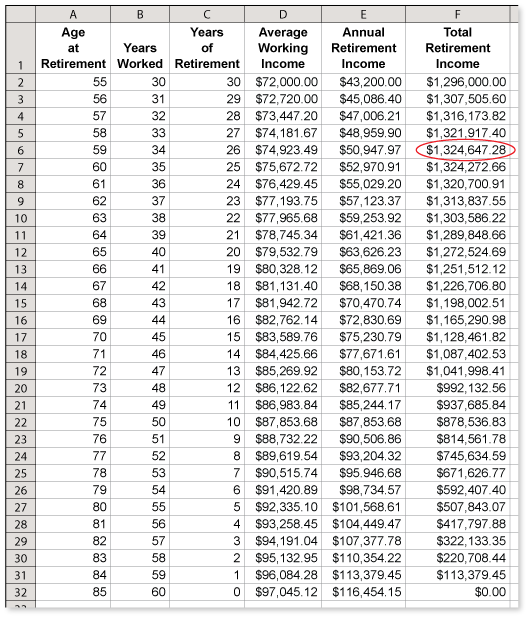

You are 55 years old and you have worked for a government municipality for 30 years. Your defined benefit retirement plan will pay you 2% of your average income for the last 3 years for each year you have worked. Your average annual income during the past 3 years is $72,000. Suppose you live to age 85.

Your salary will increase by 1% each year. At what age should you retire to receive the greatest retirement income? (See Example 6.)

-

Use a spreadsheet to analyze the possibilities.

With the given assumptions, you will earn the greatest retirement earnings by waiting until age 59.

Be sure you see that this answer is considering only one variable ... "How can I obtain the greatest retirement earnings?" The answer is based on things you don't know.

- Living to the age of 85.

- Getting only a 1% increase in salary each year.

More than this, there are many other things that should be considered in deciding when to retire.

- Your income will be less.

- You might be happier working than not working.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

You are 55 years old and you have worked for a government municipality for 30 years. Your defined benefit retirement plan will pay you 2% of your average income for the last 3 years for each year you have worked. Your average annual income during the past 3 years is $72,000. Suppose you live to age 85.

Your salary will increase by 3% each year. At what age should you retire to receive the greatest retirement income? (See Example 6.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.