-

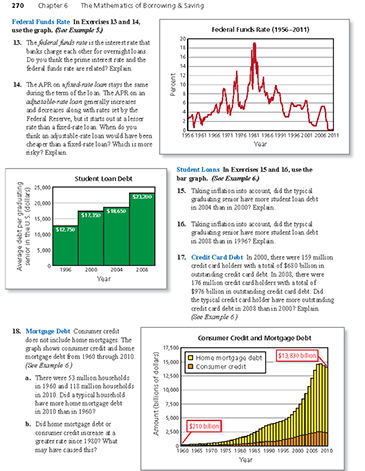

The federal funds rate is the interest rate that banks charge each other for overnight loans. Do you think the prime interest rate and the federal funds rate are related? Explain. (See Example 5.)

-

To decide whether the prime interest rate and the federal funds rate are related, align the two graphs vertically. (The prime interest rate graph is shown on page 266.)

Once the two graphs are aligned, you can see that the rises and falls of each of the two graphs occur at the same times. So,the two rates are closely related.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

The APR on a fixed-rate loan stays the same during the term of the loan. The APR on an adjustable-rate loan generally increases and decreases along with rates set by the Federal Reserve, but it starts out at a lesser rate than a fixed-rate loan. When do you think an adjustable-rate loan would have been cheaper than a fixed-rate loan? Which is more risky? Explain. (See Example 5.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Taking inflation into account, did the typical graduating senior have more student loan debt in 2004 than in 2000? Explain. (See Example 6.)

-

Use the graph to determine the average student loan debts for graduating seniors in 2000 and 2004.

2000: $17,350

2004: $18,650

To determine which of these was the greater debt, use the Consumer Price Index from page 162.

2000: CPI = 172.2

2004: CPI = 188.9

Using the formula on page 163, you can see what a debt of $17,350 in 2000 would have been in 2004.

This shows that a debt of $17,350 in the year 2000 is equivalent to a debt of $19,032.61 in the year 2004. So, although the graph appears to show that students had a greater debt in 2004, in terms of buying power, they had less debt.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Taking inflation into account, did the typical graduating senior have more student loan debt in 2008 than in 1996? Explain. (See Example 6.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

In 2000, there were 159 million credit card holders with a total of $680 billion in outstanding credit card debt. In 2008, there were 176 million credit card holders with a total of $976 billion in outstanding credit card debt. Did the typical credit card holder have more outstanding credit card debt in 2008 than in 2000? Explain. (See Example 6.)

-

Find the average credit card debt per person in 2000 and 2008.

To determine which of these was the greater debt, use the Consumer Price Index from page 162.

2000: CPI = 172.2

2004: CPI = 215.3

Using the formula on page 163, you can see what a debt of $4277 in 2000 would have been in 2008.

So, a debt of $4277 in 2000 is roughly comparable to a debt of $5347 in 2008. Considering that the actual credit card holder debt averaged $5545 in 2008, you can conclude that credit card holder debt had risen only slightly (in terms of inflation) from 2000 to 2008.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

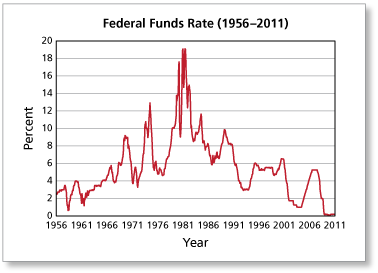

Consumer credit does not include home mortgages. The graph shows consumer credit and home mortgage debt from 1960 through 2010. (See Example 6.)

- There were 53 million households in 1960 and 118 million households in 2010. Did a typical household have more home mortgage debt in 2010 than in 1960?

- Did home mortgage debt or consumer credit increase at a greater rate since 1980? What may have caused this?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.