-

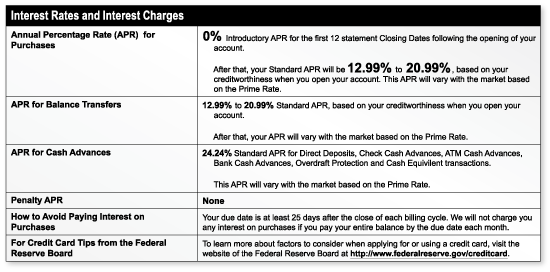

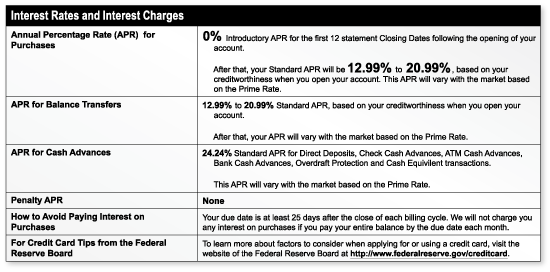

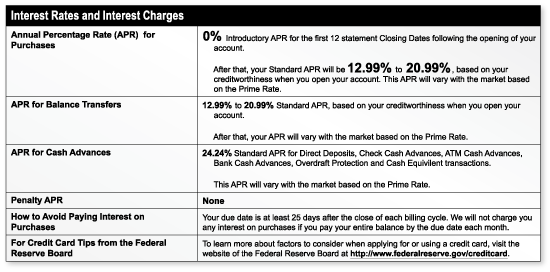

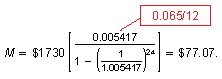

You have had a credit card for 2 years. Use the terms and conditions below that apply to your credit card.

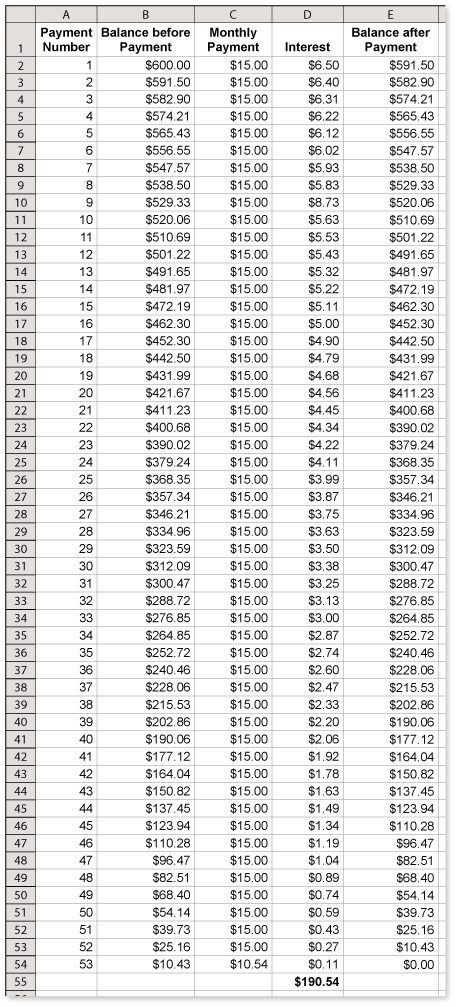

You have the lowest possible APR. You use the credit card to purchase 3 nights in a hotel for a total of $350. Your bill also includes $250 from last month. The minimum payment each month is $15. How long does it take to pay the credit card bill by making only the minimum payment each month? How much do you pay in interest? (See Example 3 and Example 4.)

-

This is a difficult question. The best way to answer it is to create a spreadsheet showing the effect of minimum payments. From the spreadsheet, you can see that it would take 53 months to pay the balance on the credit card.

By totaling the interest column, you can see that you would pay about $190.54 in interest.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

You have had a credit card for 2 years. Use the terms and conditions below that apply to your credit card.

You have the lowest possible APR. You use the credit card to purchase airplane tickets to Australia for $1500. Your bill also includes $591.50 from last month. The minimum payment is either 2% of your statement balance rounded to the nearest whole dollar or $15, whichever is greater. How long does it take to pay the credit card bill by making only the minimum payment each month? How much do you pay in interest? (See Example 3 and Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You have had a credit card for 2 years. Use the terms and conditions below that apply to your credit card.

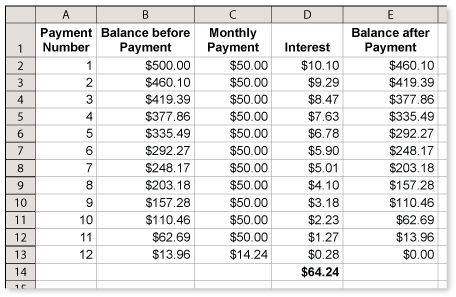

You take a cash advance of $500. How long does it take to pay for the advance by making $50 payments each month? How much do you pay in interest? (See Example 3 and Example 4.)

-

Notice that the annual percentage rate for cash advances is 24.24%.

The spreadsheet shows the number of months it would take to pay off a cash advance for $500, by making $50 payments each month. By totaling the column for interest, you can determine that your total interest payment is $64.24.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

You have had a credit card for 2 years. Use the terms and conditions below that apply to your credit card.

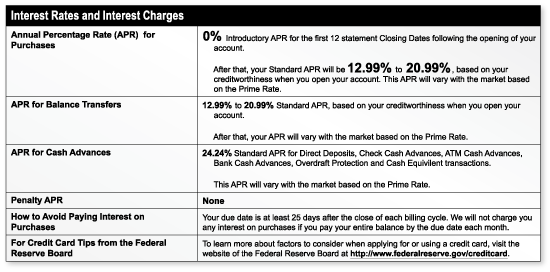

Your credit card statement is shown. You plan to pay $300 each month. How much more do you pay in interest with the maximum APR than with the minimum APR? (Note: There is an interest charge after this month.) (See Example 3 and Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

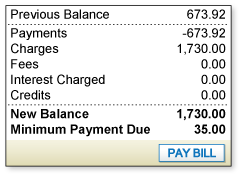

You can pay the $1730 credit card balance with a 2-year installment loan that has an APR of 6.5%, or a 1-year installment loan that has an APR of 9%. Which loan has a lesser cost of credit? How much do you save by choosing this loan? (See Example 3 and Example 4.)

-

For a 24-month loan, the annual percentage rate is 6.5%. This implies that the monthly payment is

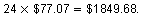

The total paid during the 2 years is

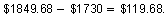

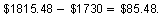

This implies that the cost of credit is

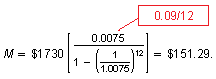

For a 12-month loan, the annual percentage rate is 9%. This implies that the monthly payment is

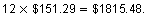

The total paid during the year is

This implies that the cost of credit is

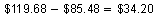

So, the one year loan has the lesser cost of credit. It costs

less than the two-year loan.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Your credit card balance is $500. You can afford to pay $100 each month toward the balance. Should you do this or should you make the minimum payment of $20 each month? Explain your reasoning.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.