-

Joe and Carolyn have been married for 45 years. In 2010, Joe retired at his full retirement age, 66. During his last year of employment, Joe had an income of $58,000. The Social Security Administration calculates that Joe's average indexed monthly earnings (AIME) is $3226.

During his last year of employment, how much should Joe have paid in Social Security tax?

-

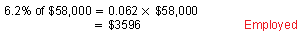

In 2010, the rate for Social Security contribuiton was 6.2% for employees and 6.2% for employers. If Joe was employed, he would have paid

in Social Security taxes. His employer would have paid the same amount towards Joe's Social Security taxes.

If Joe had been self-employed, then he would have paid the full amount by himself.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

Joe and Carolyn have been married for 45 years. In 2010, Joe retired at his full retirement age, 66. During his last year of employment, Joe had an income of $58,000. The Social Security Administration calculates that Joe's average indexed monthly earnings (AIME) is $3226.

During his last year of employment, how much should Joe have paid in Medicare tax?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Joe and Carolyn have been married for 45 years. In 2010, Joe retired at his full retirement age, 66. During his last year of employment, Joe had an income of $58,000. The Social Security Administration calculates that Joe's average indexed monthly earnings (AIME) is $3226.

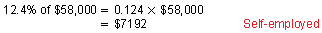

Use the Social Security benefit formula on page 241 to estimate Joe's primary insurance amount (PIA).

-

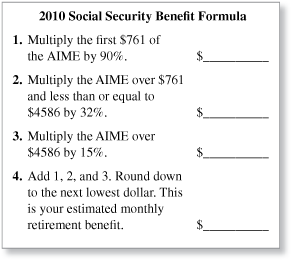

The completed formula is shown below.

So, Joe will receive $1473 in Social Security benefits each month.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Joe and Carolyn have been married for 45 years. In 2010, Joe retired at his full retirement age, 66. During his last year of employment, Joe had an income of $58,000. The Social Security Administration calculates that Joe's average indexed monthly earnings (AIME) is $3226.

Suppose Joe retired at age 62. How long would Joe have to live to make waiting for full benefits more economical? Assume a 3% cost-of-living increase each year.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Joe and Carolyn have been married for 45 years. In 2010, Joe retired at his full retirement age, 66. During his last year of employment, Joe had an income of $58,000. The Social Security Administration calculates that Joe's average indexed monthly earnings (AIME) is $3226.

Carolyn has always been a homemaker and has never paid Social Security tax. Will she qualify for Social Security retirement benefits? Explain.

-

No, Carolyn does not qualify to receive Social Security benefits.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Joe and Carolyn have been married for 45 years. In 2010, Joe retired at his full retirement age, 66. During his last year of employment, Joe had an income of $58,000. The Social Security Administration calculates that Joe's average indexed monthly earnings (AIME) is $3226.

Use the Internet to research qualifications for survivors benefits through Social Security. Suppose Joe dies before Carolyn. Will Carolyn qualify for survivors benefits? Explain.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Joe and Carolyn have been married for 45 years. In 2010, Joe retired at his full retirement age, 66. During his last year of employment, Joe had an income of $58,000. The Social Security Administration calculates that Joe's average indexed monthly earnings (AIME) is $3226.

How might the economic dependency ratio affect Joe's retirement benefits in the future?

-

No one knows the answer to this question. If the economic dependency ratio continues to drop, then it is possible that the tax burden on working people will be great enough that Social Security benefits might be lower. Because of the voting power of retired people, most people see this as unlikely. It seems more likely that the retirement age will be raised or that non-retirement benefits will be cut.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

How might the economic dependency ratio affect the qualifications for Social Security retirement benefits in the future?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.